Top 15 Cash Advance Apps Like MoneyLion in 2025

Rohan Roy

Jan 20, 2025

App Development

Introduction

In recent years, fintech apps have completely changed how we perfectly deal with personal finance\ by offering simple, free access and helping us take control of our money. Popular cash advance apps such as MoneyLion have become wildly popular because users can quickly and easily obtain emergency funds without the messiness of traditional loans or credit checks. They’re apps that offer immediate financial relief — with no interest nor hidden fees — which makes them game-changing for people facing unexpected expenses.

As such apps are on the rise, users can cross that gap between paychecks or deal with an emergency without going for payday loans with prohibitive interest rates. As these apps evolve, they’re getting more user-friendly and feature-rich, with budgeting tools, credit score monitoring, and more.

To find the best 15 cash advance apps like MoneyLion, this blog will teach you what to look for when looking for a financial tool. Whether you want some extra cash or a full financial platform, this list can serve as viable alternatives for what you’re looking for.

What is an Instant Cash Advance App?

Instant cash advance app is an app type that enables users to get small loans or cash advances instantaneously before the next paycheck. The apps are meant to give quick financial relief from things like medical bills, car repair, or shopping at the grocery store.

Cash advance apps are also unlike traditional loans, which do not require a credit check or extensive approval process. They also make them a good option, especially for people with poor or no credit history.

However, cash advance apps tend to provide a small amount of money that has to be paid back as they get the next paycheck; some apps charge a small fee or ask for voluntary tips, while others give you interest-free advances.

The user-friendly and fast approval processes these apps offer have earned them popularity as a convenient way to get fast cash without any long-term commitment to the finances.

What is MoneyLion?

A popular financial wellness platform, MoneyLion provides services to help users effectively manage their financial lives. The app is powerful and sophisticated and encompasses many features such as account monitoring, account budgeting tools, financial planning resources, personal loans, and many more in one neat and convenient app. First, its claim to fame is that it offers the ability to get funds when needed—filling the gap between paychecks or unexpected expenses.

MoneyLion offers a standout cash advance service. It offers users access to small loans or cash advances against their upcoming paychecks without the high interest and hidden fee baggage often associated with payday loans. Users of MoneyLion can borrow up to $250 in cash advances, and that doesn’t involve carrying out a credit check, which makes it an option for those with dodgy or poor credit histories.

The app's simplicity and transparency around its terms make it a surprisingly popular choice among those needing immediate, fast relief. In addition, MoneyLion provides tools to build credit and financial education to help users achieve financial health overall.

Requirements and Costs Associated with MoneyLion

Users of MoneyLion must sign up for an account, which is free, although there may be a monthly cost for the features. Premium subscription cost range, but they have a few tiers with added perks like increased cash advance limit, free credit monitoring and investment tools.

The free plan provides access to the platform's tools, including the small cash advance and small budgeting features. However, users might be subject to fees for certain transactions, including expedited transfers.

Best 15 Cash Advance Apps Like MoneyLion in 2025

The Top 15 Cash Advance Apps Like MoneyLion in 2025 With All The Features of Quick Hairy-Free Immediate Available Cash To Use For Meeting Short-Term Financial Requirements.

Brigit

Brigit is an app that provides fast access to emergency funds with a cash advance. This one actually supplies instant cash advances of up to $250 with zero credit checks, making it perfect for folks who require money they don’t have until payday.

It also monitors potential overdraft fees to track users' bank accounts and when they might need to top up their accounts. Brigit offers a subscription-based service that helps people be financially stable.

Chime

One of those services is SpotMe, which is Chime's cash advance feature that functions like a line of credit: a revolving credit limit that you can borrow from at any time, so long as it's less than your maximum available limit. Users can borrow up to $200 in overdraft protection with fees or interest charges without fee.

Chime has no monthly fees and is available to use two days early on direct paychecks. The app also offers automatic savings tools and credit-building resources for financial health.

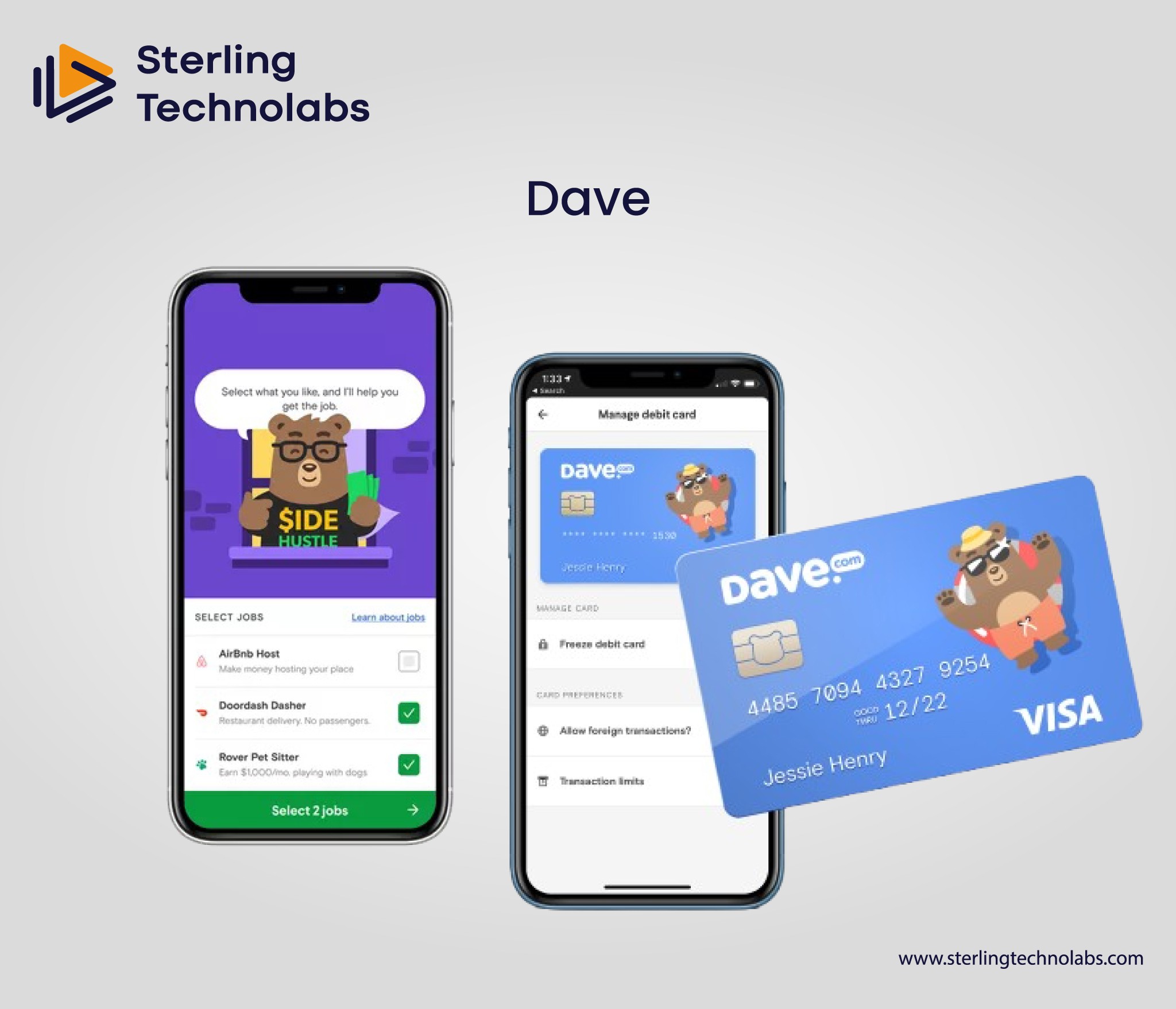

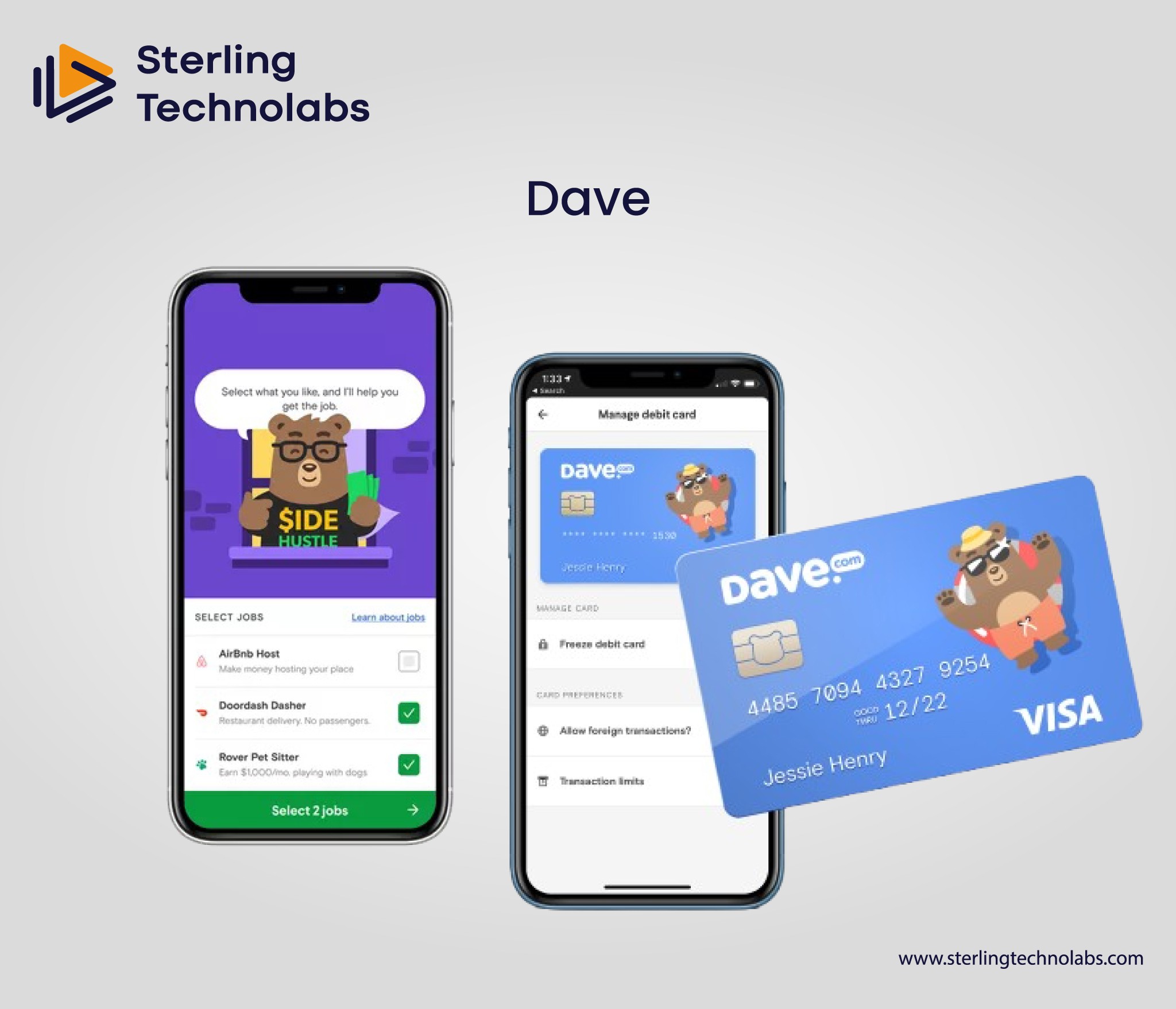

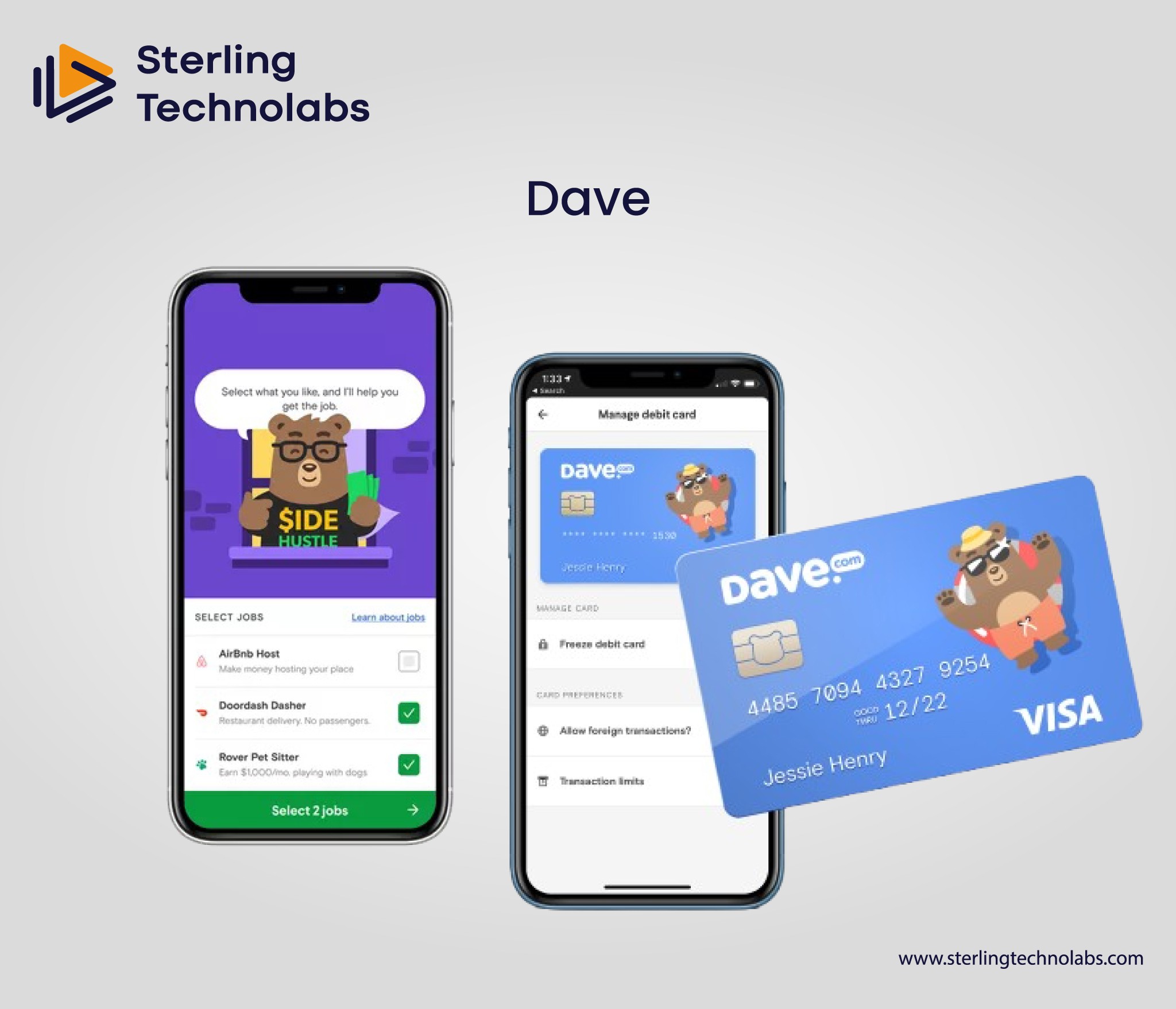

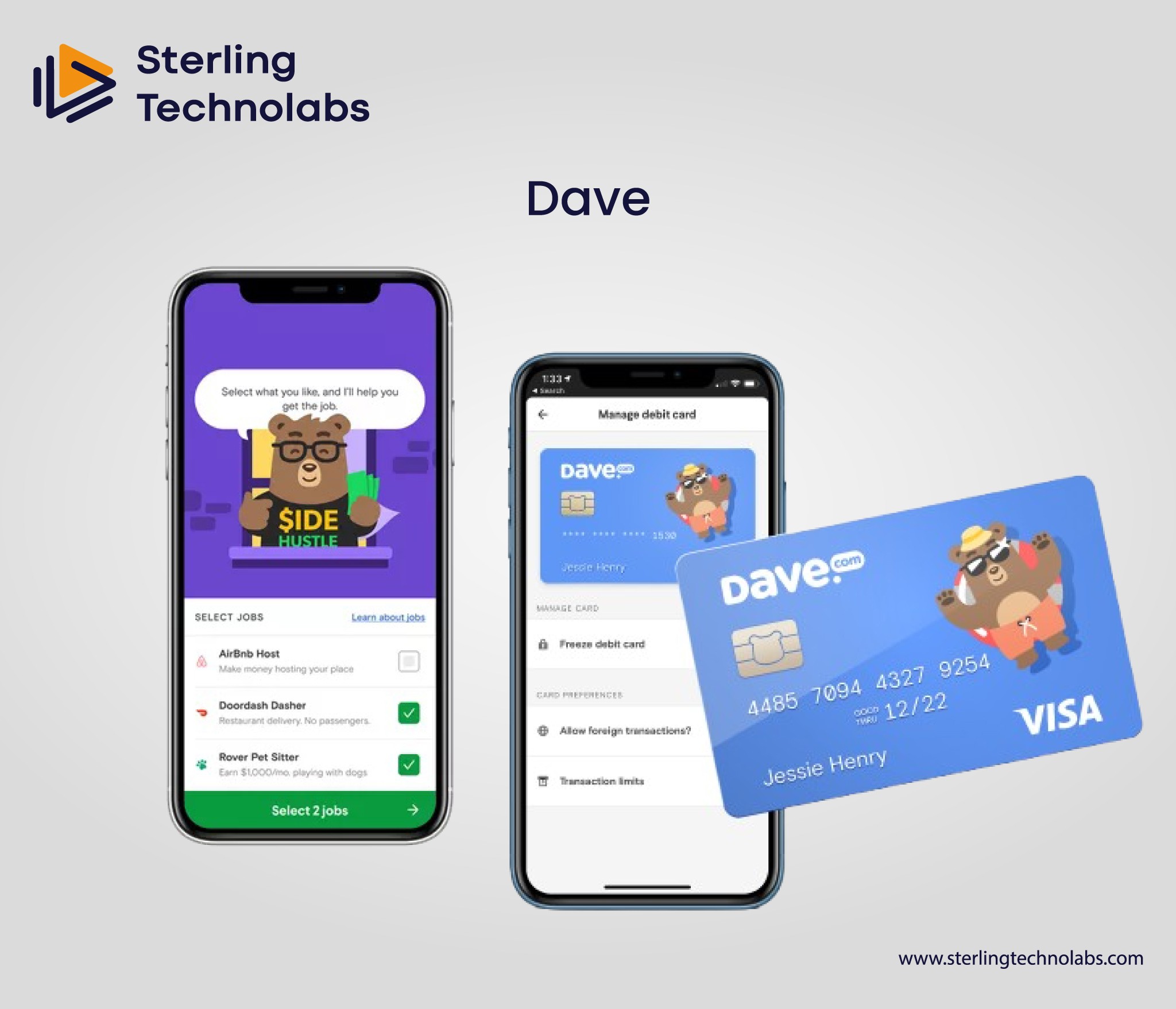

Dave

Dave is a mobile app that offers small cash advances of up to $200 without credit checks or interest fees. It also allows users to avoid overdraft fees by offering early payday advances.

In addition, Dave provides budgeting tips and financial insights, tracking spending and steering clear of the many pitfalls that create financial strain. There is also a cash-back reward available to app users who make purchases.

Affirm

Buy now, pay later (BNPL) platform Affirm is known for providing flexible finances for consumers. Through Affirm, you can break a purchase up into instalments, making more expensive purchases less overwhelming.

The app charges transparent terms and no hidden fees and offers financing options from 3 to 12 months. Affirm lets you instantly know whether you’re eligible, and thousands of online retailers accept it, so it’s a popular alternative to traditional credit cards.

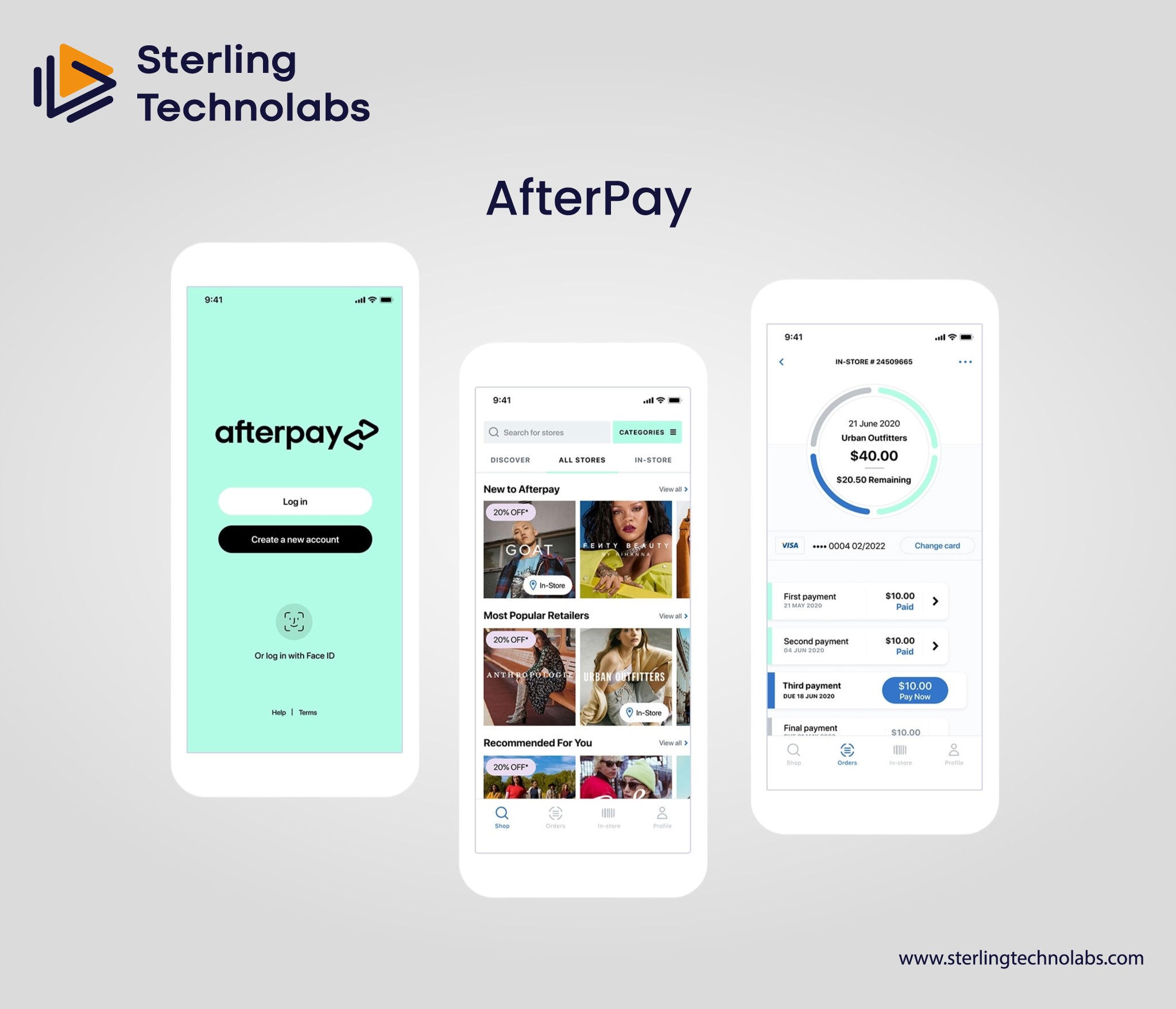

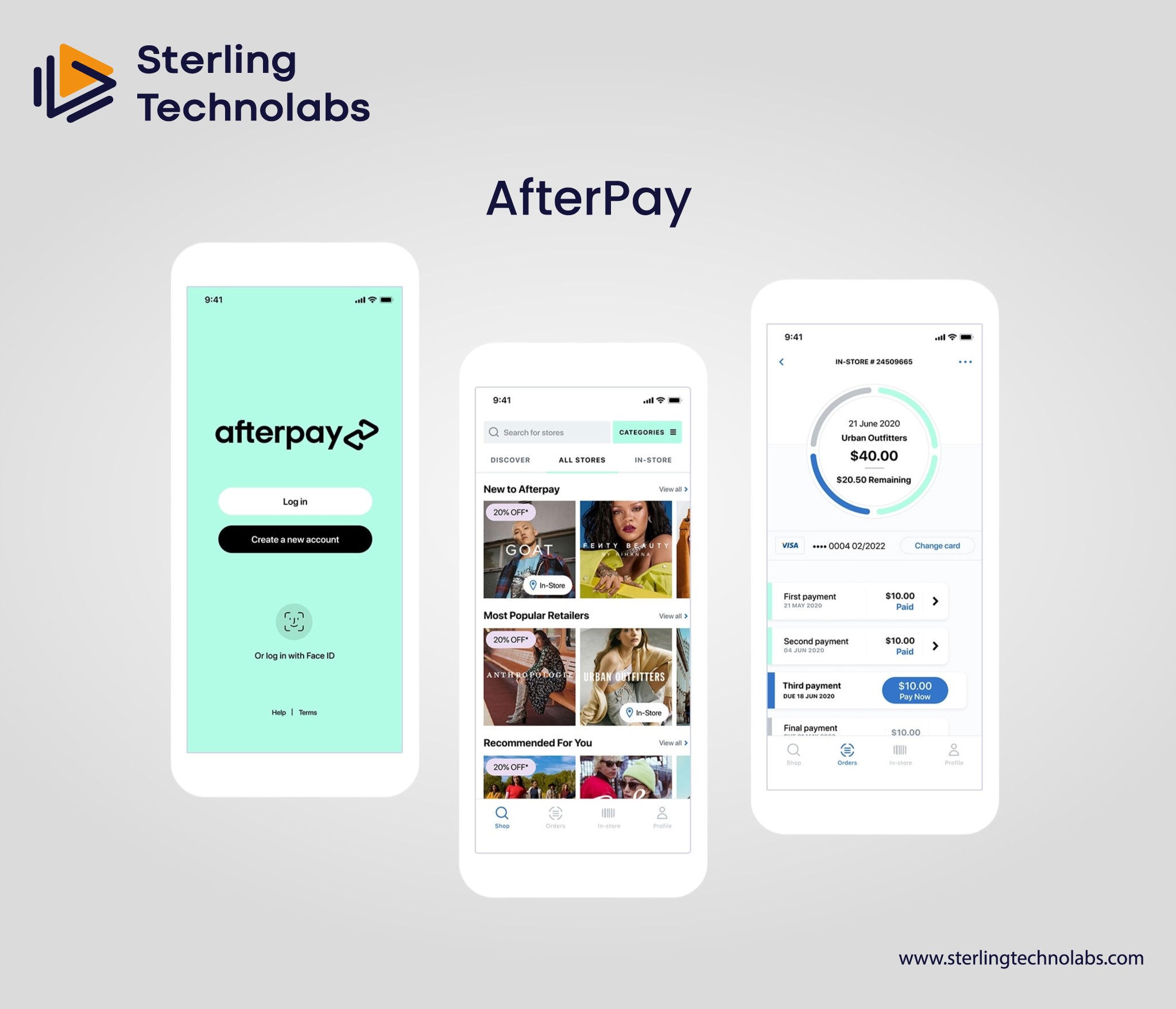

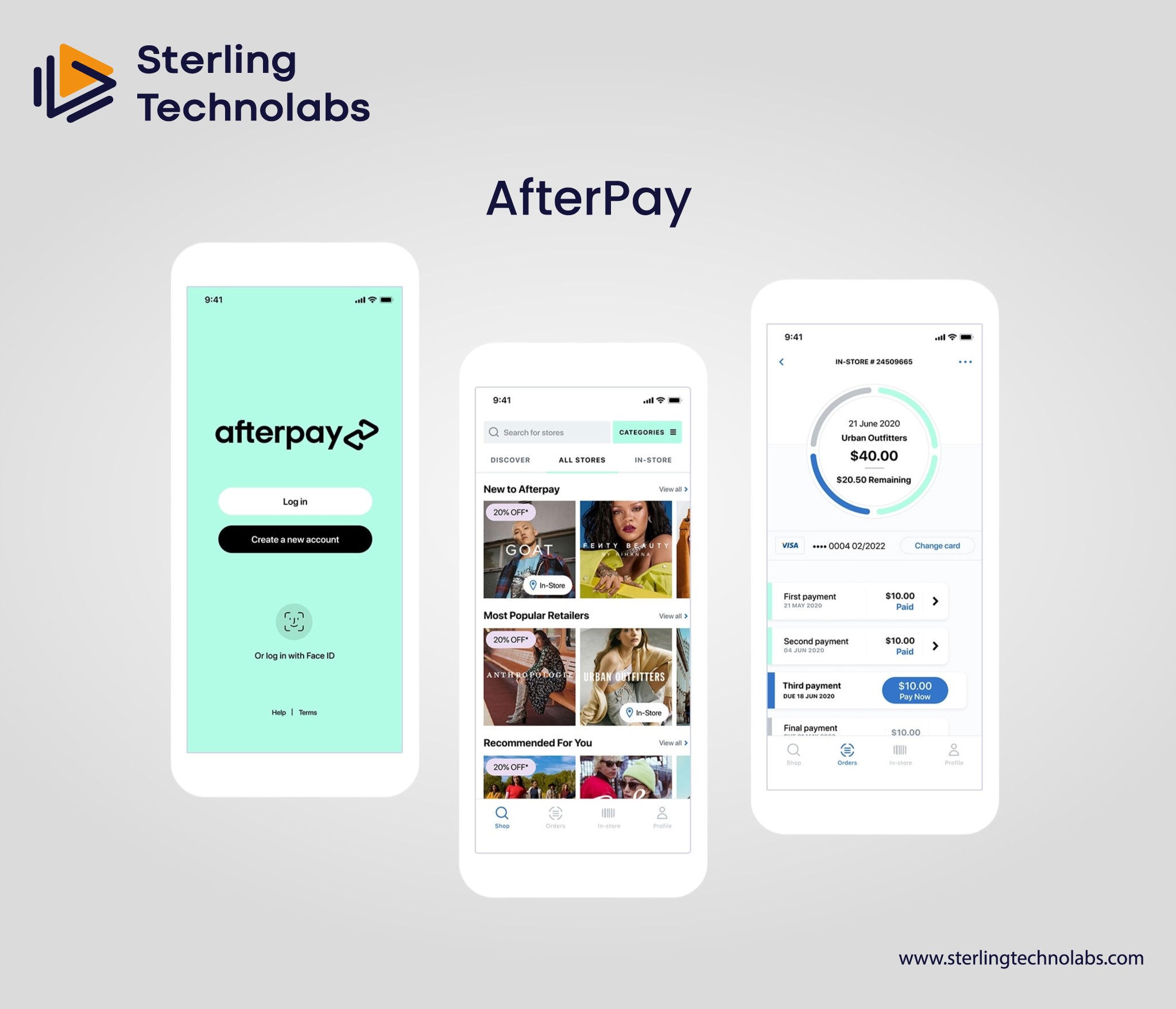

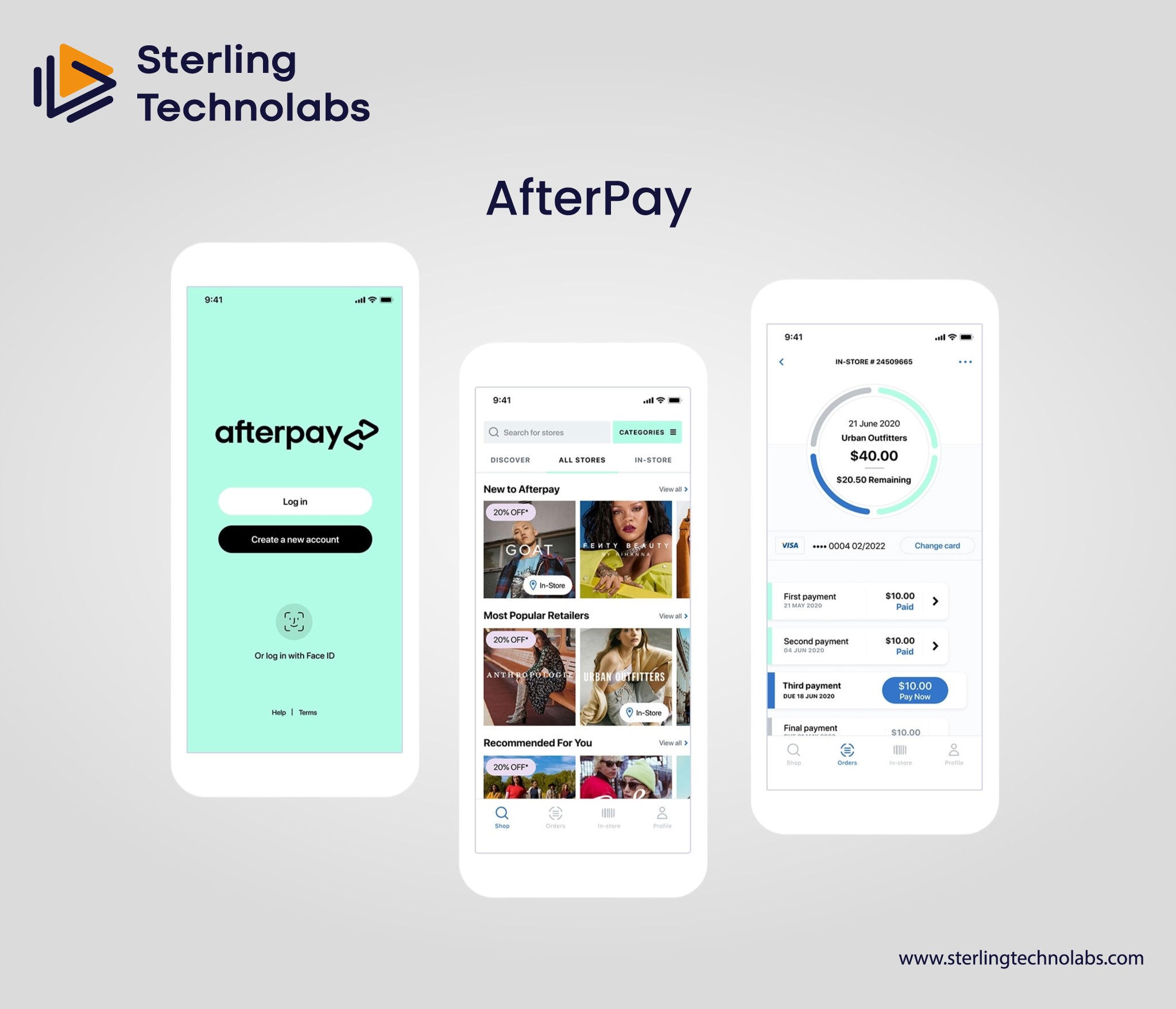

AfterPay

The buy now, pay later app AfterPay splits purchases into four instalments, which are paid every two weeks without interest. Online shoppers can appreciate that it is popular for accepting payments with flexible payment terms and no fees, provided payments are made on time—easy access to procure and pay for the products later.

AfterPay provides users with ease in managing their spending. A lot of retailers accept and have a mobile app to manage purchases, and a lot of retailers accept it.

Klover

Klover is a cash advance financial app powered by paycheck history. This allows you to get up to $200 in instant cash, no credit checks, no fees, and no interest. Klover gets data from users' bank accounts to guess future income and which cash advances are approved.

The app also offers budgeting tools and financial insights for easier management of the user's finances. Klover is a free, transparent, low-cost way to get money in your pocket quickly and inadvertently.

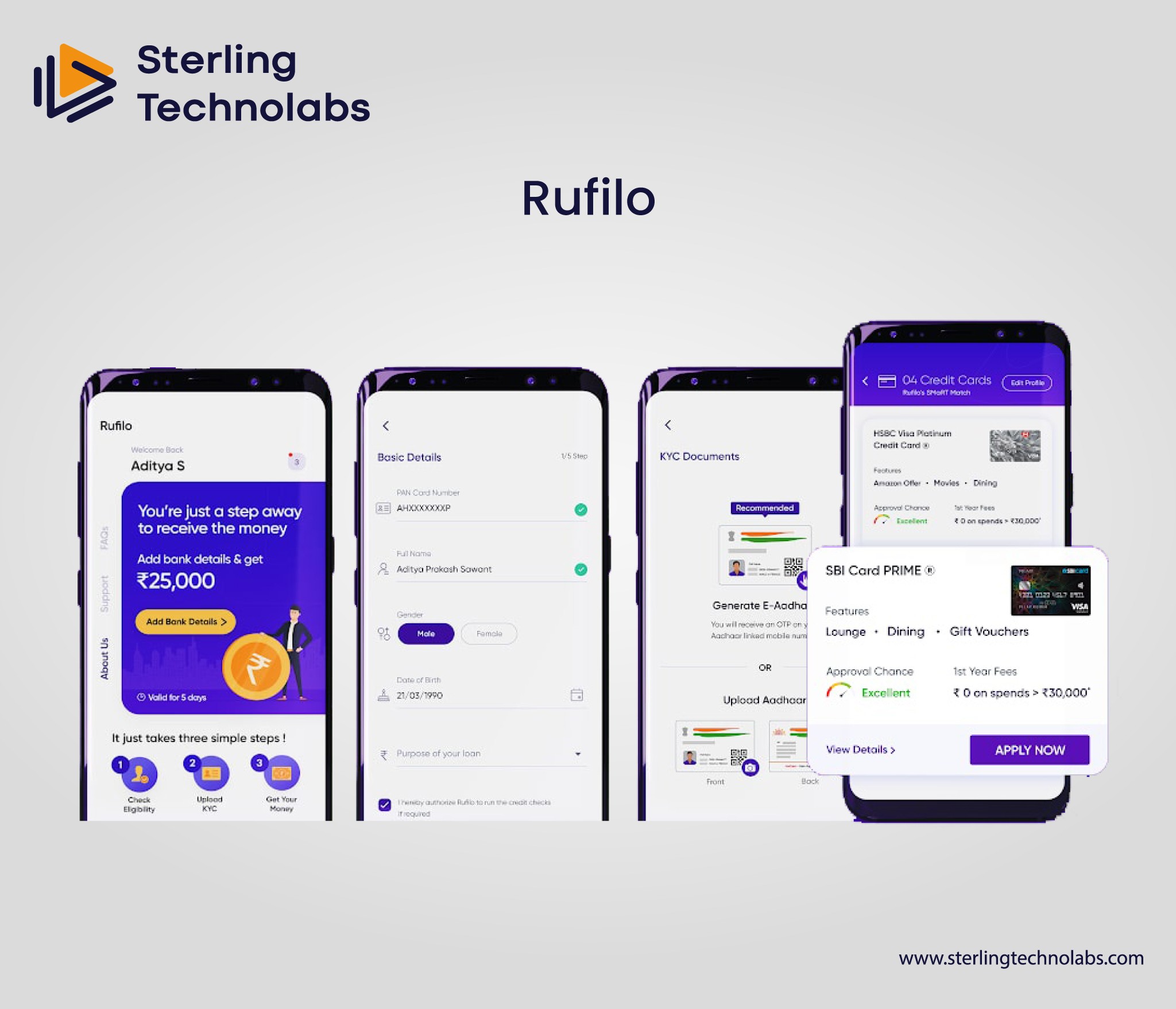

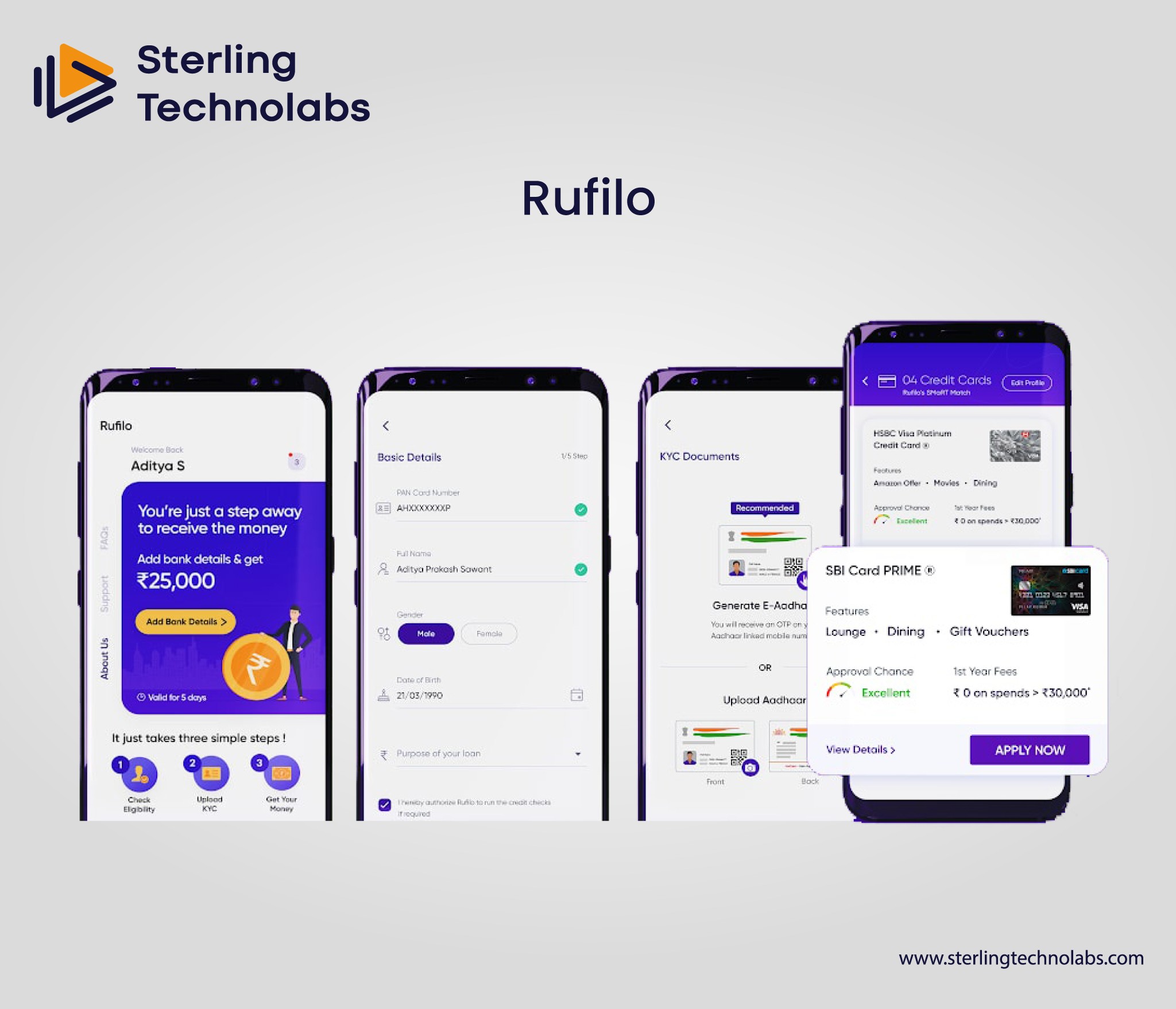

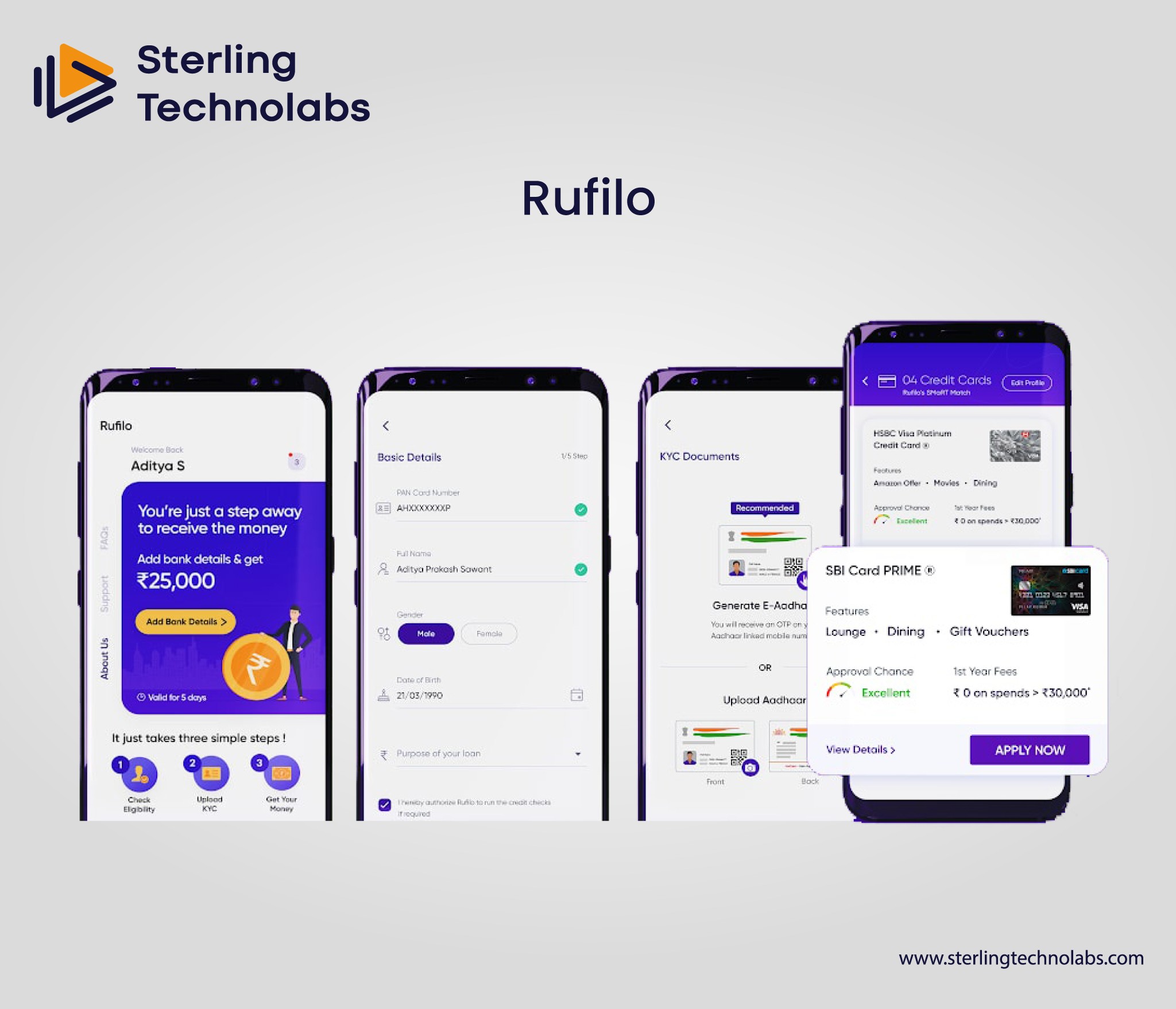

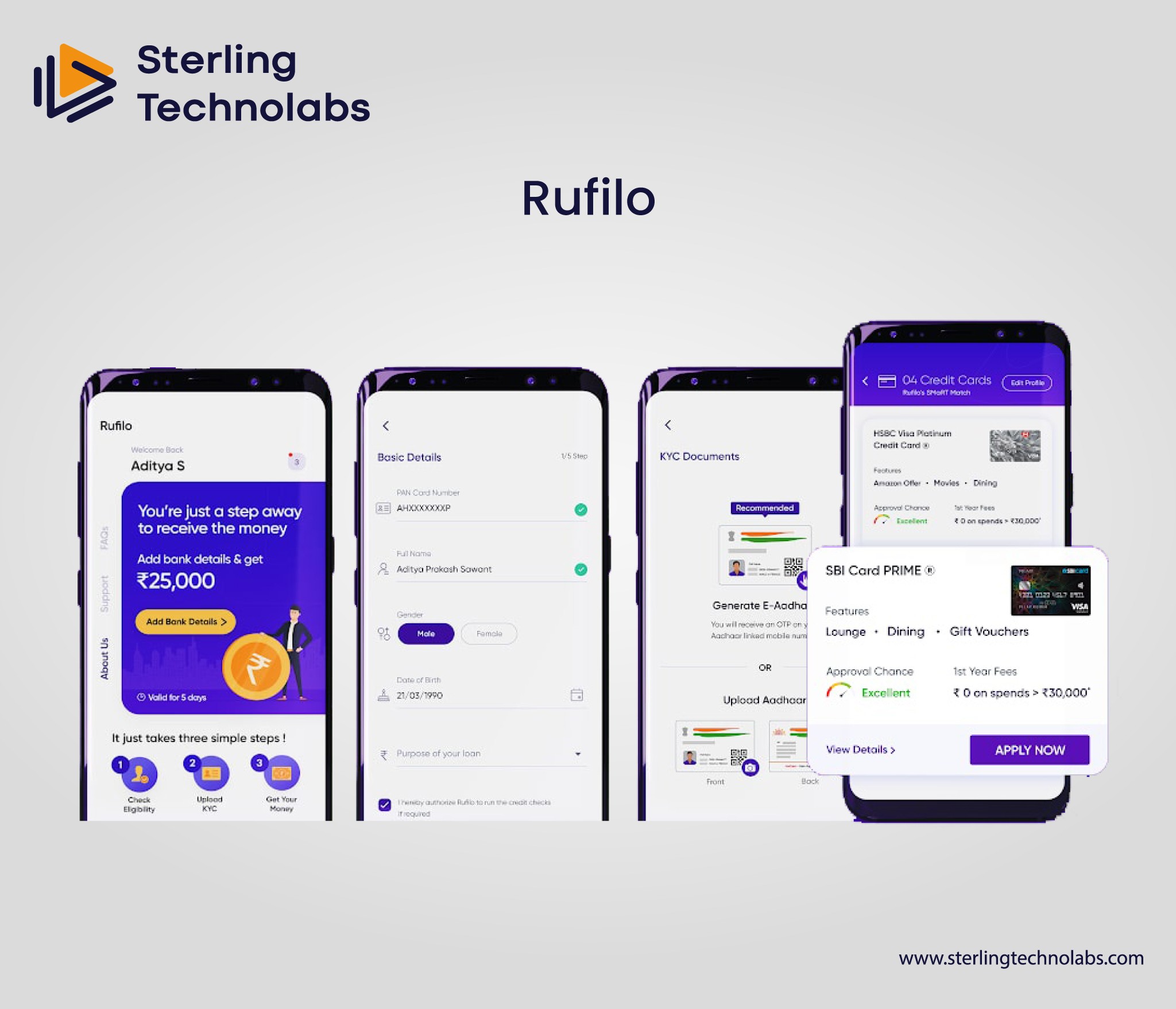

Rufilo

Rufilo is a personal finance app that provides cash advances and instant loan facilities up to $250. With no credit checks, the app makes it easy to use for those with a poor or limited credit history.

Rufilo also provides users with budgeting and money management tools to keep them out of future financial troubles. Its basic services come with no interest or fees, so it is a convenient way to get access to money fast, which can be helpful when you need money fast and need it cheap.

Pocketly

Pocketly is a user-friendly mobile app that manages short-term financial emergencies by offering cash advances of up to $250. It has no credit check requirements and is suitable for anyone with different credit histories.

The app also offers automatic saving tools and financial management features to help users track spending and avoid getting trapped in future financial pitfalls. Pocketly intends to make transactions fast and reliable for its users by using a user-friendly interface.

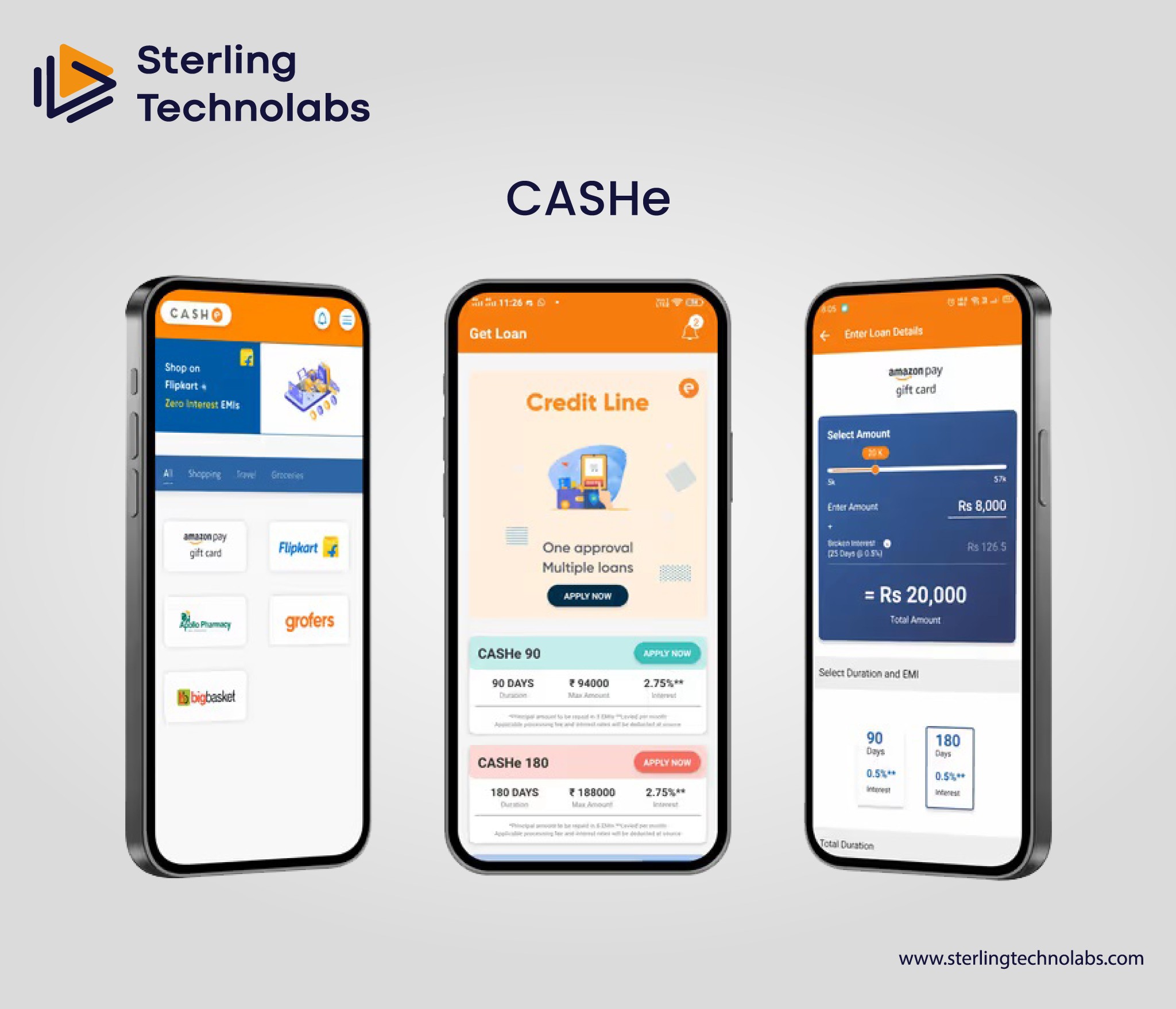

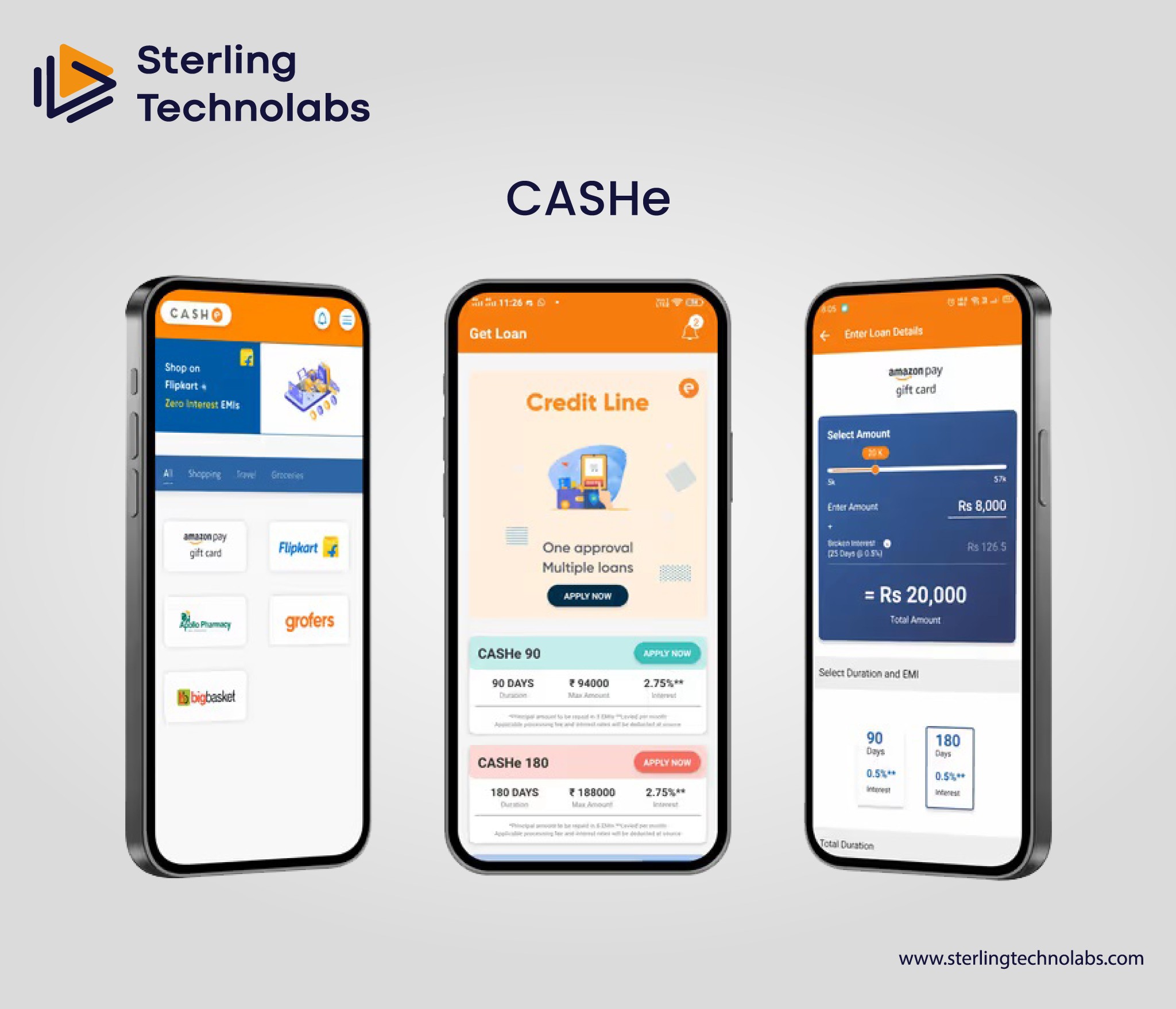

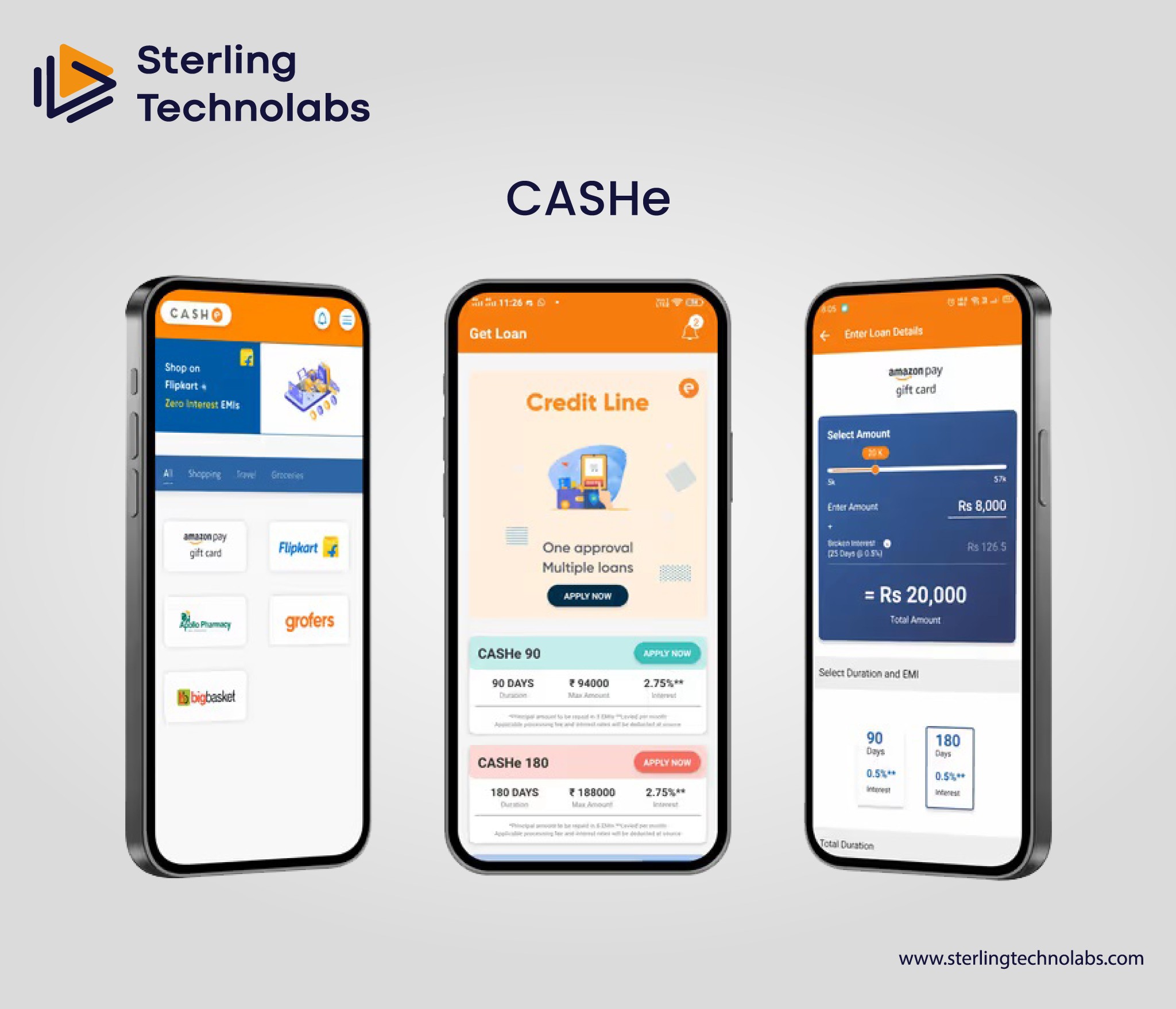

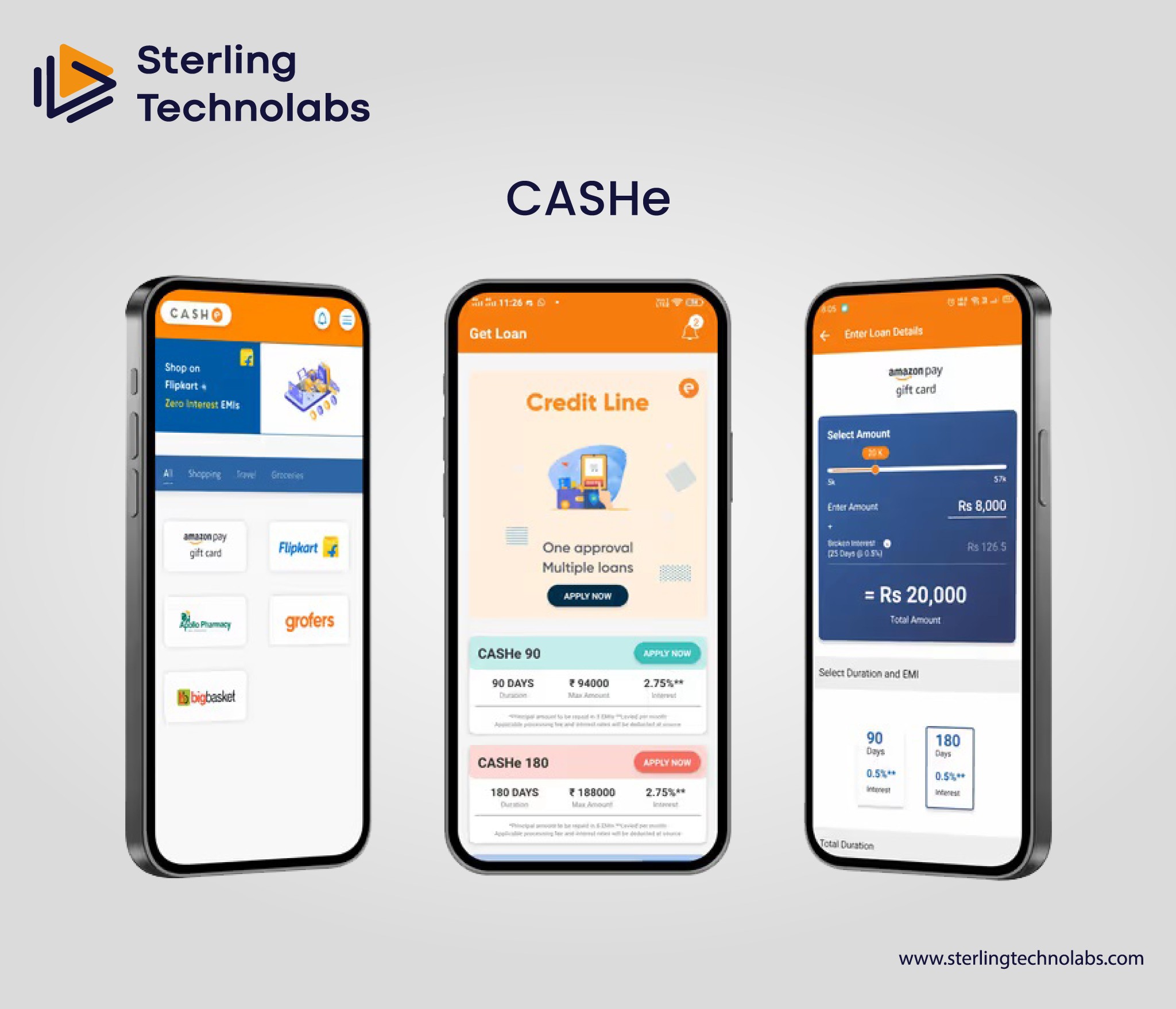

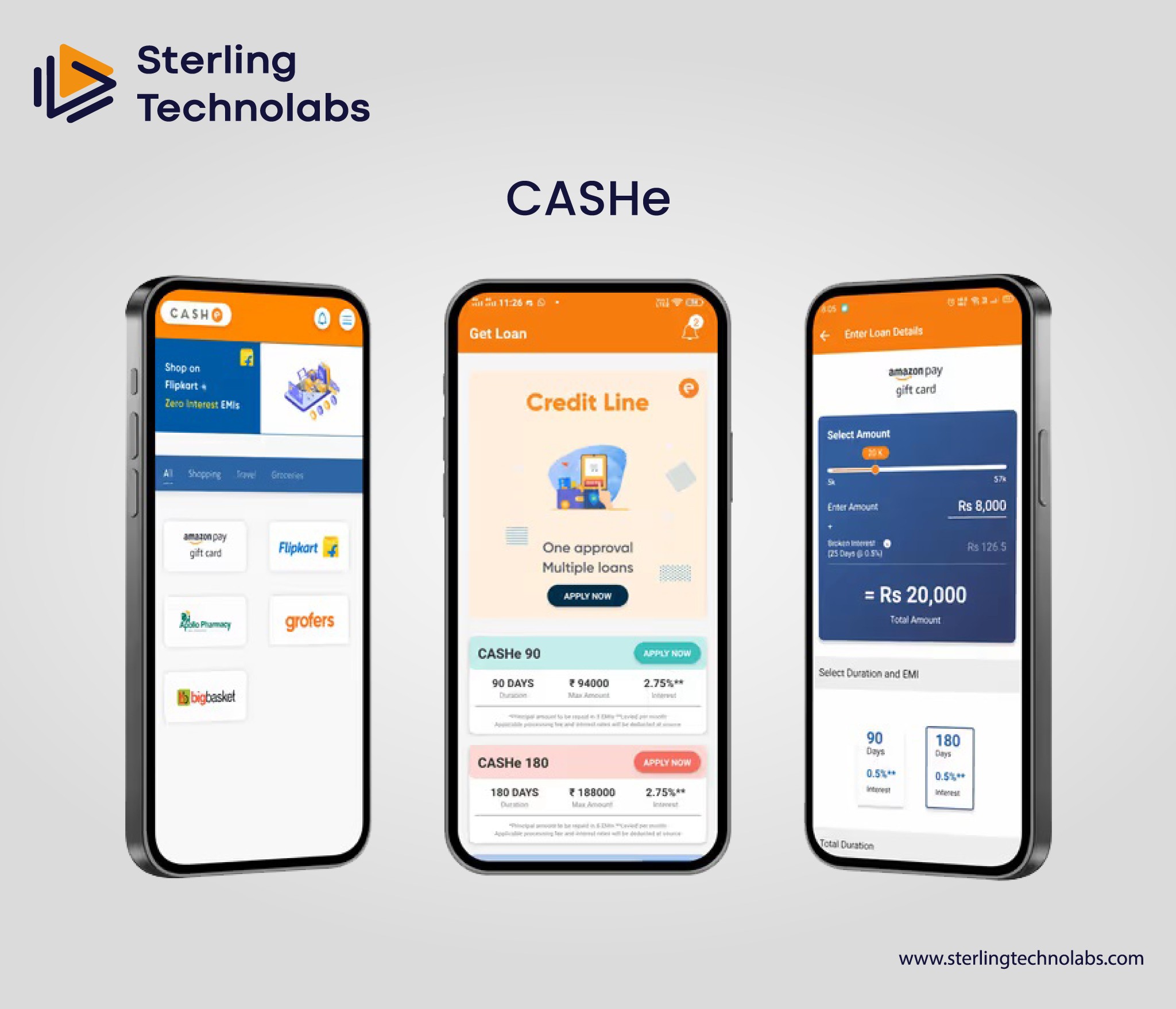

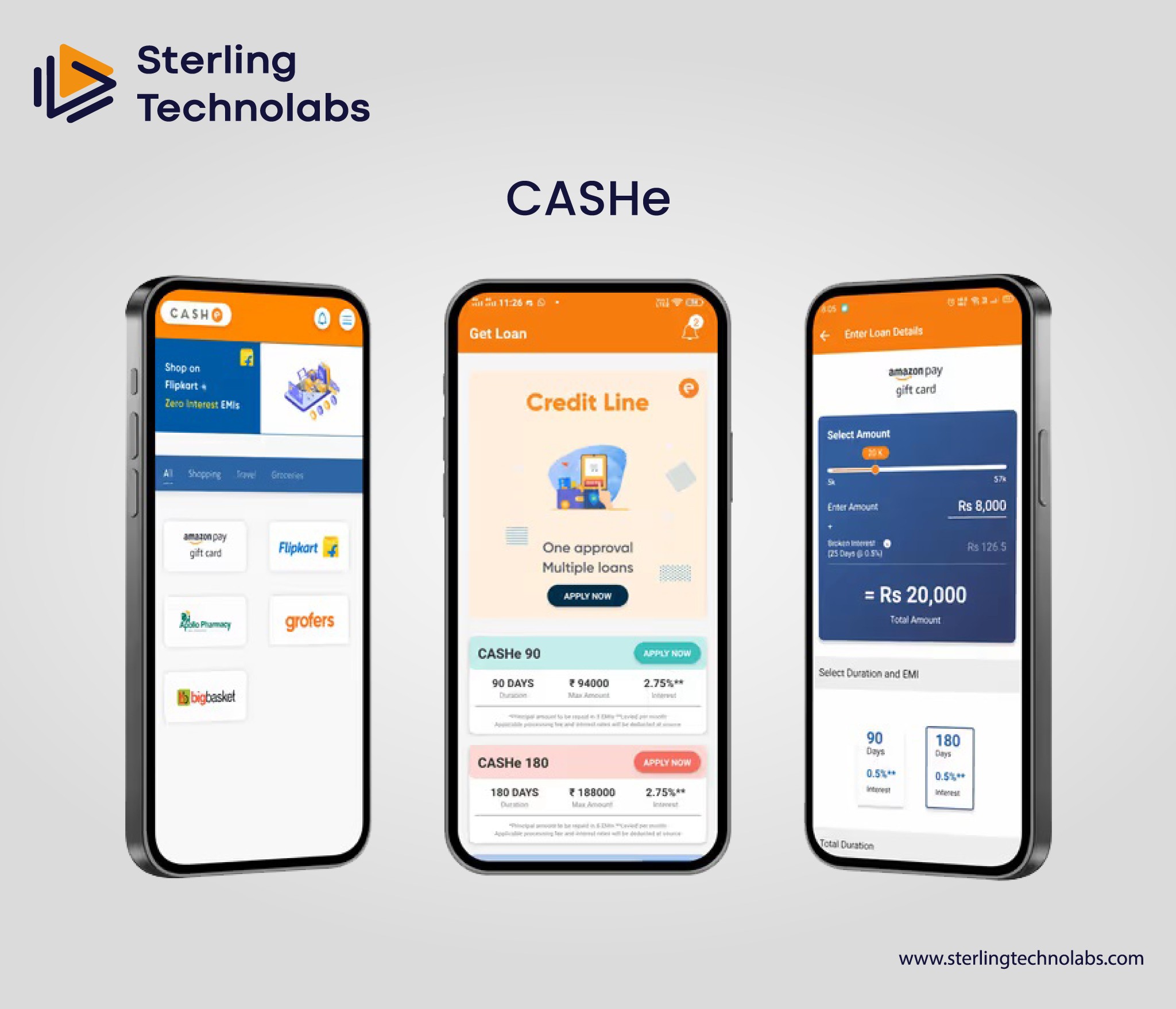

CASHe

CASHe is a cash advance app that advances cash to users as per their financial needs without the hassle. With flexibility on repayment and minimal interest rates, CASHe offers cash advances upto ₹5,000 to ₹1,00,000.

The app uses social scoring to assess eligibility, so it doesn’t depend on traditional credit checks. Furthermore, it gives users customized loan offers and financial education tools to assist users in making knowledgeable decisions about their money.

FlexWage

FlexWage is an EWA service that lets employees access their earned wages before paydays. The FlexWage app allows users to access up to 50% of their earned wages, giving them a financial cushion between paychecks.

Its service helps employees avoid payday loans and overdraft fees. FlexWage integrates well with employers' payroll systems, ensuring a seamless experience for its users looking to access their wages early.

Empower

Empower is a mobile app designed to enable its users to maintain proper finance management using an automated savings and budgeting tool. Users are offered the facility to receive cash advances up to $250 without credit checks and no interest fees.

Artificial intelligence is used in this application, which analyses users' expenditure habits and guides them toward saving money automatically. It also gives customised financial recommendations for bettering the financial health of its users and decreasing avoidable expenditures.

Earnin

Earnin is an application that gives users access to earned wages before payday. Withdrawals are allowed for up to $100 per day without interest or credit checks. It allows the users to pay only what they consider fair for the service.

It has a pay-what-you-can model. The app also provides balance alerts, timecard tracking, and a wellness program made to help the user keep their financial health in place by managing cash flow appropriately.

Cleo

Cleo is a budgeting and cash advance app that gives users easy financial tools to manage their spending and save. It provides cash advances up to $100 with no interest or hidden fees.

Furthermore, Cleo offers budgeting tools, personalised spending insights, and financial advice to improve user financial decisions. Cleo engages users in a conversational format and uses artificial intelligence to promote a fun, interactive manner in improving their financial health.

PayActiv

PayActiv is an app for earned wage access that lets users access their hard-earned wages before payday comes in. It offers them an advance of up to 50% of a user's earned wages free from interest or credit check implications.

PayActiv features some financial wellness tools that help users manage how to spend their money appropriately, including bill payments, transferring money, and directing savings from their earned wages. This works in harmony with employers' payroll systems and is a fantastic tool for employees looking to avoid payday loans.

Avant Credit

Avant Credit provides loans from $2,000 to $35,000. Although it does not qualify as a more conventional cash advance app, it still allows consumers to receive money through unsecured personal loans.

It offers reasonable interest rates and flexible repayment options, which is highly suited for larger, longer-term financial needs. Avant Credit offers a relatively straightforward platform to manage your loan and thus remains the most trusted for customers irrespective of credit scores.

Here's a table for the top 15 applications like MoneyLion that similarly provide services such as cash advances and financial health monitoring and the rest:

How Do Cash Apps Work?

Cash advance apps get a hold of your bank account and let you take small amounts of money whenever your next paycheck comes and repay it. These are such a quick solution because these apps usually don’t require credit checks.

The apps calculate your borrowing limit based on your income and repayment history. Almost all of the apps on this list have a subscription or fee-based model, or they are free unless you tip the app developer.

5 Key Features to Look for in a Cash Advance App Like MoneyLion

When selecting a cash advance app, consider these five key features:

Instant Money Access: The main reason why cash advance apps are popular is that it’s so easy to get your hands on cash right away. Apps that allow you to instantly transfer cash into your account, such as a linked debit card, are what you should look for.

No Credit Check: Many cash advance apps do not require a credit check, making them available for people with poor credit. Those in need of immediate relief but facing traditional credit approval processes will discover this feature particularly useful.

Low Fees or No Fees: Although some are fee-free or run based on tips, these apps are actually cheaper than payday loans. Choose apps with transparent costs.

Flexible Repayment Terms: The best cash advance app will allow you to make repayments in terms that match your paydays. This enables users to break down the cycle of debt.

Additional Financial Tools: Apps like MoneyLion come with budgeting, savings, and even credit-building tools that can increase the app's overall value. Check out apps that offer more than just the cash advance feature and supply resources to help you manage your finances if any issues arise.

Conclusion

Fintech businesses are currently able to tap into this growing market as the demand for instant cash advance apps has soared. The recent obsession with mobile-based financial solutions makes developing an app similar to MoneyLion extremely profitable. Long-term engagement will offer users quick access to funds and allow businesses to offer budgeting tools, credit score tracking, and financial management features.

As a business, potential cash advance app companies can monetise by means of subscription models, transaction fees and partnerships with credit providers. These apps can quickly attract a large user base by offering a seamless and easy-to-use experience. Businesses can also utilize data insight to come up with the type of financial products and services customers need.

Moreover, as mobile app development in the fintech sector evolves, incorporating AI, machine learning, and rich analytics will enable businesses to create more personal financial solutions. This helps make cash advance apps relevant, reliable, and profitable in a changing financial landscape.

FAQs

Q: How much does it cost to develop a similar app?

A: Depends on the features and complexity, but developing money lion app like Cash Advance app might cost you $50,000 to $200,000.

Q: What technologies are used to build apps like MoneyLion?

A: Popular technologies include mobile app frameworks such as React Native or Flutter, backend technologies such as Node.js or Ruby on Rails, and cloud services like AWS or Google Cloud.

Q: How long does it take to develop a fintech app?

A: This process takes roughly 4 to 6 months to develop, depending on the complexity of the features, testing, and regulatory compliance.

Q: How do you ensure data security in financial apps?

A: Encryption, two-factor authentication, security audits, and our 100% compliance with financial regulations such as GDPR and PCI DSS are ways we prove data security.

Q: Can these apps integrate with third-party financial services?

A: Indeed, some cash advance apps partner with third party financial services, including payment processors, credit score services and budgeting applications to add value for users.

Introduction

In recent years, fintech apps have completely changed how we perfectly deal with personal finance\ by offering simple, free access and helping us take control of our money. Popular cash advance apps such as MoneyLion have become wildly popular because users can quickly and easily obtain emergency funds without the messiness of traditional loans or credit checks. They’re apps that offer immediate financial relief — with no interest nor hidden fees — which makes them game-changing for people facing unexpected expenses.

As such apps are on the rise, users can cross that gap between paychecks or deal with an emergency without going for payday loans with prohibitive interest rates. As these apps evolve, they’re getting more user-friendly and feature-rich, with budgeting tools, credit score monitoring, and more.

To find the best 15 cash advance apps like MoneyLion, this blog will teach you what to look for when looking for a financial tool. Whether you want some extra cash or a full financial platform, this list can serve as viable alternatives for what you’re looking for.

What is an Instant Cash Advance App?

Instant cash advance app is an app type that enables users to get small loans or cash advances instantaneously before the next paycheck. The apps are meant to give quick financial relief from things like medical bills, car repair, or shopping at the grocery store.

Cash advance apps are also unlike traditional loans, which do not require a credit check or extensive approval process. They also make them a good option, especially for people with poor or no credit history.

However, cash advance apps tend to provide a small amount of money that has to be paid back as they get the next paycheck; some apps charge a small fee or ask for voluntary tips, while others give you interest-free advances.

The user-friendly and fast approval processes these apps offer have earned them popularity as a convenient way to get fast cash without any long-term commitment to the finances.

What is MoneyLion?

A popular financial wellness platform, MoneyLion provides services to help users effectively manage their financial lives. The app is powerful and sophisticated and encompasses many features such as account monitoring, account budgeting tools, financial planning resources, personal loans, and many more in one neat and convenient app. First, its claim to fame is that it offers the ability to get funds when needed—filling the gap between paychecks or unexpected expenses.

MoneyLion offers a standout cash advance service. It offers users access to small loans or cash advances against their upcoming paychecks without the high interest and hidden fee baggage often associated with payday loans. Users of MoneyLion can borrow up to $250 in cash advances, and that doesn’t involve carrying out a credit check, which makes it an option for those with dodgy or poor credit histories.

The app's simplicity and transparency around its terms make it a surprisingly popular choice among those needing immediate, fast relief. In addition, MoneyLion provides tools to build credit and financial education to help users achieve financial health overall.

Requirements and Costs Associated with MoneyLion

Users of MoneyLion must sign up for an account, which is free, although there may be a monthly cost for the features. Premium subscription cost range, but they have a few tiers with added perks like increased cash advance limit, free credit monitoring and investment tools.

The free plan provides access to the platform's tools, including the small cash advance and small budgeting features. However, users might be subject to fees for certain transactions, including expedited transfers.

Best 15 Cash Advance Apps Like MoneyLion in 2025

The Top 15 Cash Advance Apps Like MoneyLion in 2025 With All The Features of Quick Hairy-Free Immediate Available Cash To Use For Meeting Short-Term Financial Requirements.

Brigit

Brigit is an app that provides fast access to emergency funds with a cash advance. This one actually supplies instant cash advances of up to $250 with zero credit checks, making it perfect for folks who require money they don’t have until payday.

It also monitors potential overdraft fees to track users' bank accounts and when they might need to top up their accounts. Brigit offers a subscription-based service that helps people be financially stable.

Chime

One of those services is SpotMe, which is Chime's cash advance feature that functions like a line of credit: a revolving credit limit that you can borrow from at any time, so long as it's less than your maximum available limit. Users can borrow up to $200 in overdraft protection with fees or interest charges without fee.

Chime has no monthly fees and is available to use two days early on direct paychecks. The app also offers automatic savings tools and credit-building resources for financial health.

Dave

Dave is a mobile app that offers small cash advances of up to $200 without credit checks or interest fees. It also allows users to avoid overdraft fees by offering early payday advances.

In addition, Dave provides budgeting tips and financial insights, tracking spending and steering clear of the many pitfalls that create financial strain. There is also a cash-back reward available to app users who make purchases.

Affirm

Buy now, pay later (BNPL) platform Affirm is known for providing flexible finances for consumers. Through Affirm, you can break a purchase up into instalments, making more expensive purchases less overwhelming.

The app charges transparent terms and no hidden fees and offers financing options from 3 to 12 months. Affirm lets you instantly know whether you’re eligible, and thousands of online retailers accept it, so it’s a popular alternative to traditional credit cards.

AfterPay

The buy now, pay later app AfterPay splits purchases into four instalments, which are paid every two weeks without interest. Online shoppers can appreciate that it is popular for accepting payments with flexible payment terms and no fees, provided payments are made on time—easy access to procure and pay for the products later.

AfterPay provides users with ease in managing their spending. A lot of retailers accept and have a mobile app to manage purchases, and a lot of retailers accept it.

Klover

Klover is a cash advance financial app powered by paycheck history. This allows you to get up to $200 in instant cash, no credit checks, no fees, and no interest. Klover gets data from users' bank accounts to guess future income and which cash advances are approved.

The app also offers budgeting tools and financial insights for easier management of the user's finances. Klover is a free, transparent, low-cost way to get money in your pocket quickly and inadvertently.

Rufilo

Rufilo is a personal finance app that provides cash advances and instant loan facilities up to $250. With no credit checks, the app makes it easy to use for those with a poor or limited credit history.

Rufilo also provides users with budgeting and money management tools to keep them out of future financial troubles. Its basic services come with no interest or fees, so it is a convenient way to get access to money fast, which can be helpful when you need money fast and need it cheap.

Pocketly

Pocketly is a user-friendly mobile app that manages short-term financial emergencies by offering cash advances of up to $250. It has no credit check requirements and is suitable for anyone with different credit histories.

The app also offers automatic saving tools and financial management features to help users track spending and avoid getting trapped in future financial pitfalls. Pocketly intends to make transactions fast and reliable for its users by using a user-friendly interface.

CASHe

CASHe is a cash advance app that advances cash to users as per their financial needs without the hassle. With flexibility on repayment and minimal interest rates, CASHe offers cash advances upto ₹5,000 to ₹1,00,000.

The app uses social scoring to assess eligibility, so it doesn’t depend on traditional credit checks. Furthermore, it gives users customized loan offers and financial education tools to assist users in making knowledgeable decisions about their money.

FlexWage

FlexWage is an EWA service that lets employees access their earned wages before paydays. The FlexWage app allows users to access up to 50% of their earned wages, giving them a financial cushion between paychecks.

Its service helps employees avoid payday loans and overdraft fees. FlexWage integrates well with employers' payroll systems, ensuring a seamless experience for its users looking to access their wages early.

Empower

Empower is a mobile app designed to enable its users to maintain proper finance management using an automated savings and budgeting tool. Users are offered the facility to receive cash advances up to $250 without credit checks and no interest fees.

Artificial intelligence is used in this application, which analyses users' expenditure habits and guides them toward saving money automatically. It also gives customised financial recommendations for bettering the financial health of its users and decreasing avoidable expenditures.

Earnin

Earnin is an application that gives users access to earned wages before payday. Withdrawals are allowed for up to $100 per day without interest or credit checks. It allows the users to pay only what they consider fair for the service.

It has a pay-what-you-can model. The app also provides balance alerts, timecard tracking, and a wellness program made to help the user keep their financial health in place by managing cash flow appropriately.

Cleo

Cleo is a budgeting and cash advance app that gives users easy financial tools to manage their spending and save. It provides cash advances up to $100 with no interest or hidden fees.

Furthermore, Cleo offers budgeting tools, personalised spending insights, and financial advice to improve user financial decisions. Cleo engages users in a conversational format and uses artificial intelligence to promote a fun, interactive manner in improving their financial health.

PayActiv

PayActiv is an app for earned wage access that lets users access their hard-earned wages before payday comes in. It offers them an advance of up to 50% of a user's earned wages free from interest or credit check implications.

PayActiv features some financial wellness tools that help users manage how to spend their money appropriately, including bill payments, transferring money, and directing savings from their earned wages. This works in harmony with employers' payroll systems and is a fantastic tool for employees looking to avoid payday loans.

Avant Credit

Avant Credit provides loans from $2,000 to $35,000. Although it does not qualify as a more conventional cash advance app, it still allows consumers to receive money through unsecured personal loans.

It offers reasonable interest rates and flexible repayment options, which is highly suited for larger, longer-term financial needs. Avant Credit offers a relatively straightforward platform to manage your loan and thus remains the most trusted for customers irrespective of credit scores.

Here's a table for the top 15 applications like MoneyLion that similarly provide services such as cash advances and financial health monitoring and the rest:

How Do Cash Apps Work?

Cash advance apps get a hold of your bank account and let you take small amounts of money whenever your next paycheck comes and repay it. These are such a quick solution because these apps usually don’t require credit checks.

The apps calculate your borrowing limit based on your income and repayment history. Almost all of the apps on this list have a subscription or fee-based model, or they are free unless you tip the app developer.

5 Key Features to Look for in a Cash Advance App Like MoneyLion

When selecting a cash advance app, consider these five key features:

Instant Money Access: The main reason why cash advance apps are popular is that it’s so easy to get your hands on cash right away. Apps that allow you to instantly transfer cash into your account, such as a linked debit card, are what you should look for.

No Credit Check: Many cash advance apps do not require a credit check, making them available for people with poor credit. Those in need of immediate relief but facing traditional credit approval processes will discover this feature particularly useful.

Low Fees or No Fees: Although some are fee-free or run based on tips, these apps are actually cheaper than payday loans. Choose apps with transparent costs.

Flexible Repayment Terms: The best cash advance app will allow you to make repayments in terms that match your paydays. This enables users to break down the cycle of debt.

Additional Financial Tools: Apps like MoneyLion come with budgeting, savings, and even credit-building tools that can increase the app's overall value. Check out apps that offer more than just the cash advance feature and supply resources to help you manage your finances if any issues arise.

Conclusion

Fintech businesses are currently able to tap into this growing market as the demand for instant cash advance apps has soared. The recent obsession with mobile-based financial solutions makes developing an app similar to MoneyLion extremely profitable. Long-term engagement will offer users quick access to funds and allow businesses to offer budgeting tools, credit score tracking, and financial management features.

As a business, potential cash advance app companies can monetise by means of subscription models, transaction fees and partnerships with credit providers. These apps can quickly attract a large user base by offering a seamless and easy-to-use experience. Businesses can also utilize data insight to come up with the type of financial products and services customers need.

Moreover, as mobile app development in the fintech sector evolves, incorporating AI, machine learning, and rich analytics will enable businesses to create more personal financial solutions. This helps make cash advance apps relevant, reliable, and profitable in a changing financial landscape.

FAQs

Q: How much does it cost to develop a similar app?

A: Depends on the features and complexity, but developing money lion app like Cash Advance app might cost you $50,000 to $200,000.

Q: What technologies are used to build apps like MoneyLion?

A: Popular technologies include mobile app frameworks such as React Native or Flutter, backend technologies such as Node.js or Ruby on Rails, and cloud services like AWS or Google Cloud.

Q: How long does it take to develop a fintech app?

A: This process takes roughly 4 to 6 months to develop, depending on the complexity of the features, testing, and regulatory compliance.

Q: How do you ensure data security in financial apps?

A: Encryption, two-factor authentication, security audits, and our 100% compliance with financial regulations such as GDPR and PCI DSS are ways we prove data security.

Q: Can these apps integrate with third-party financial services?

A: Indeed, some cash advance apps partner with third party financial services, including payment processors, credit score services and budgeting applications to add value for users.

Introduction

In recent years, fintech apps have completely changed how we perfectly deal with personal finance\ by offering simple, free access and helping us take control of our money. Popular cash advance apps such as MoneyLion have become wildly popular because users can quickly and easily obtain emergency funds without the messiness of traditional loans or credit checks. They’re apps that offer immediate financial relief — with no interest nor hidden fees — which makes them game-changing for people facing unexpected expenses.

As such apps are on the rise, users can cross that gap between paychecks or deal with an emergency without going for payday loans with prohibitive interest rates. As these apps evolve, they’re getting more user-friendly and feature-rich, with budgeting tools, credit score monitoring, and more.

To find the best 15 cash advance apps like MoneyLion, this blog will teach you what to look for when looking for a financial tool. Whether you want some extra cash or a full financial platform, this list can serve as viable alternatives for what you’re looking for.

What is an Instant Cash Advance App?

Instant cash advance app is an app type that enables users to get small loans or cash advances instantaneously before the next paycheck. The apps are meant to give quick financial relief from things like medical bills, car repair, or shopping at the grocery store.

Cash advance apps are also unlike traditional loans, which do not require a credit check or extensive approval process. They also make them a good option, especially for people with poor or no credit history.

However, cash advance apps tend to provide a small amount of money that has to be paid back as they get the next paycheck; some apps charge a small fee or ask for voluntary tips, while others give you interest-free advances.

The user-friendly and fast approval processes these apps offer have earned them popularity as a convenient way to get fast cash without any long-term commitment to the finances.

What is MoneyLion?

A popular financial wellness platform, MoneyLion provides services to help users effectively manage their financial lives. The app is powerful and sophisticated and encompasses many features such as account monitoring, account budgeting tools, financial planning resources, personal loans, and many more in one neat and convenient app. First, its claim to fame is that it offers the ability to get funds when needed—filling the gap between paychecks or unexpected expenses.

MoneyLion offers a standout cash advance service. It offers users access to small loans or cash advances against their upcoming paychecks without the high interest and hidden fee baggage often associated with payday loans. Users of MoneyLion can borrow up to $250 in cash advances, and that doesn’t involve carrying out a credit check, which makes it an option for those with dodgy or poor credit histories.

The app's simplicity and transparency around its terms make it a surprisingly popular choice among those needing immediate, fast relief. In addition, MoneyLion provides tools to build credit and financial education to help users achieve financial health overall.

Requirements and Costs Associated with MoneyLion

Users of MoneyLion must sign up for an account, which is free, although there may be a monthly cost for the features. Premium subscription cost range, but they have a few tiers with added perks like increased cash advance limit, free credit monitoring and investment tools.

The free plan provides access to the platform's tools, including the small cash advance and small budgeting features. However, users might be subject to fees for certain transactions, including expedited transfers.

Best 15 Cash Advance Apps Like MoneyLion in 2025

The Top 15 Cash Advance Apps Like MoneyLion in 2025 With All The Features of Quick Hairy-Free Immediate Available Cash To Use For Meeting Short-Term Financial Requirements.

Brigit

Brigit is an app that provides fast access to emergency funds with a cash advance. This one actually supplies instant cash advances of up to $250 with zero credit checks, making it perfect for folks who require money they don’t have until payday.

It also monitors potential overdraft fees to track users' bank accounts and when they might need to top up their accounts. Brigit offers a subscription-based service that helps people be financially stable.

Chime

One of those services is SpotMe, which is Chime's cash advance feature that functions like a line of credit: a revolving credit limit that you can borrow from at any time, so long as it's less than your maximum available limit. Users can borrow up to $200 in overdraft protection with fees or interest charges without fee.

Chime has no monthly fees and is available to use two days early on direct paychecks. The app also offers automatic savings tools and credit-building resources for financial health.

Dave

Dave is a mobile app that offers small cash advances of up to $200 without credit checks or interest fees. It also allows users to avoid overdraft fees by offering early payday advances.

In addition, Dave provides budgeting tips and financial insights, tracking spending and steering clear of the many pitfalls that create financial strain. There is also a cash-back reward available to app users who make purchases.

Affirm

Buy now, pay later (BNPL) platform Affirm is known for providing flexible finances for consumers. Through Affirm, you can break a purchase up into instalments, making more expensive purchases less overwhelming.

The app charges transparent terms and no hidden fees and offers financing options from 3 to 12 months. Affirm lets you instantly know whether you’re eligible, and thousands of online retailers accept it, so it’s a popular alternative to traditional credit cards.

AfterPay

The buy now, pay later app AfterPay splits purchases into four instalments, which are paid every two weeks without interest. Online shoppers can appreciate that it is popular for accepting payments with flexible payment terms and no fees, provided payments are made on time—easy access to procure and pay for the products later.

AfterPay provides users with ease in managing their spending. A lot of retailers accept and have a mobile app to manage purchases, and a lot of retailers accept it.

Klover

Klover is a cash advance financial app powered by paycheck history. This allows you to get up to $200 in instant cash, no credit checks, no fees, and no interest. Klover gets data from users' bank accounts to guess future income and which cash advances are approved.

The app also offers budgeting tools and financial insights for easier management of the user's finances. Klover is a free, transparent, low-cost way to get money in your pocket quickly and inadvertently.

Rufilo

Rufilo is a personal finance app that provides cash advances and instant loan facilities up to $250. With no credit checks, the app makes it easy to use for those with a poor or limited credit history.

Rufilo also provides users with budgeting and money management tools to keep them out of future financial troubles. Its basic services come with no interest or fees, so it is a convenient way to get access to money fast, which can be helpful when you need money fast and need it cheap.

Pocketly

Pocketly is a user-friendly mobile app that manages short-term financial emergencies by offering cash advances of up to $250. It has no credit check requirements and is suitable for anyone with different credit histories.

The app also offers automatic saving tools and financial management features to help users track spending and avoid getting trapped in future financial pitfalls. Pocketly intends to make transactions fast and reliable for its users by using a user-friendly interface.

CASHe

CASHe is a cash advance app that advances cash to users as per their financial needs without the hassle. With flexibility on repayment and minimal interest rates, CASHe offers cash advances upto ₹5,000 to ₹1,00,000.

The app uses social scoring to assess eligibility, so it doesn’t depend on traditional credit checks. Furthermore, it gives users customized loan offers and financial education tools to assist users in making knowledgeable decisions about their money.

FlexWage

FlexWage is an EWA service that lets employees access their earned wages before paydays. The FlexWage app allows users to access up to 50% of their earned wages, giving them a financial cushion between paychecks.

Its service helps employees avoid payday loans and overdraft fees. FlexWage integrates well with employers' payroll systems, ensuring a seamless experience for its users looking to access their wages early.

Empower

Empower is a mobile app designed to enable its users to maintain proper finance management using an automated savings and budgeting tool. Users are offered the facility to receive cash advances up to $250 without credit checks and no interest fees.

Artificial intelligence is used in this application, which analyses users' expenditure habits and guides them toward saving money automatically. It also gives customised financial recommendations for bettering the financial health of its users and decreasing avoidable expenditures.

Earnin

Earnin is an application that gives users access to earned wages before payday. Withdrawals are allowed for up to $100 per day without interest or credit checks. It allows the users to pay only what they consider fair for the service.

It has a pay-what-you-can model. The app also provides balance alerts, timecard tracking, and a wellness program made to help the user keep their financial health in place by managing cash flow appropriately.

Cleo

Cleo is a budgeting and cash advance app that gives users easy financial tools to manage their spending and save. It provides cash advances up to $100 with no interest or hidden fees.

Furthermore, Cleo offers budgeting tools, personalised spending insights, and financial advice to improve user financial decisions. Cleo engages users in a conversational format and uses artificial intelligence to promote a fun, interactive manner in improving their financial health.

PayActiv

PayActiv is an app for earned wage access that lets users access their hard-earned wages before payday comes in. It offers them an advance of up to 50% of a user's earned wages free from interest or credit check implications.

PayActiv features some financial wellness tools that help users manage how to spend their money appropriately, including bill payments, transferring money, and directing savings from their earned wages. This works in harmony with employers' payroll systems and is a fantastic tool for employees looking to avoid payday loans.

Avant Credit

Avant Credit provides loans from $2,000 to $35,000. Although it does not qualify as a more conventional cash advance app, it still allows consumers to receive money through unsecured personal loans.

It offers reasonable interest rates and flexible repayment options, which is highly suited for larger, longer-term financial needs. Avant Credit offers a relatively straightforward platform to manage your loan and thus remains the most trusted for customers irrespective of credit scores.

Here's a table for the top 15 applications like MoneyLion that similarly provide services such as cash advances and financial health monitoring and the rest:

How Do Cash Apps Work?

Cash advance apps get a hold of your bank account and let you take small amounts of money whenever your next paycheck comes and repay it. These are such a quick solution because these apps usually don’t require credit checks.

The apps calculate your borrowing limit based on your income and repayment history. Almost all of the apps on this list have a subscription or fee-based model, or they are free unless you tip the app developer.

5 Key Features to Look for in a Cash Advance App Like MoneyLion

When selecting a cash advance app, consider these five key features:

Instant Money Access: The main reason why cash advance apps are popular is that it’s so easy to get your hands on cash right away. Apps that allow you to instantly transfer cash into your account, such as a linked debit card, are what you should look for.

No Credit Check: Many cash advance apps do not require a credit check, making them available for people with poor credit. Those in need of immediate relief but facing traditional credit approval processes will discover this feature particularly useful.

Low Fees or No Fees: Although some are fee-free or run based on tips, these apps are actually cheaper than payday loans. Choose apps with transparent costs.

Flexible Repayment Terms: The best cash advance app will allow you to make repayments in terms that match your paydays. This enables users to break down the cycle of debt.

Additional Financial Tools: Apps like MoneyLion come with budgeting, savings, and even credit-building tools that can increase the app's overall value. Check out apps that offer more than just the cash advance feature and supply resources to help you manage your finances if any issues arise.

Conclusion

Fintech businesses are currently able to tap into this growing market as the demand for instant cash advance apps has soared. The recent obsession with mobile-based financial solutions makes developing an app similar to MoneyLion extremely profitable. Long-term engagement will offer users quick access to funds and allow businesses to offer budgeting tools, credit score tracking, and financial management features.

As a business, potential cash advance app companies can monetise by means of subscription models, transaction fees and partnerships with credit providers. These apps can quickly attract a large user base by offering a seamless and easy-to-use experience. Businesses can also utilize data insight to come up with the type of financial products and services customers need.

Moreover, as mobile app development in the fintech sector evolves, incorporating AI, machine learning, and rich analytics will enable businesses to create more personal financial solutions. This helps make cash advance apps relevant, reliable, and profitable in a changing financial landscape.

FAQs

Q: How much does it cost to develop a similar app?

A: Depends on the features and complexity, but developing money lion app like Cash Advance app might cost you $50,000 to $200,000.

Q: What technologies are used to build apps like MoneyLion?

A: Popular technologies include mobile app frameworks such as React Native or Flutter, backend technologies such as Node.js or Ruby on Rails, and cloud services like AWS or Google Cloud.

Q: How long does it take to develop a fintech app?

A: This process takes roughly 4 to 6 months to develop, depending on the complexity of the features, testing, and regulatory compliance.

Q: How do you ensure data security in financial apps?

A: Encryption, two-factor authentication, security audits, and our 100% compliance with financial regulations such as GDPR and PCI DSS are ways we prove data security.

Q: Can these apps integrate with third-party financial services?

A: Indeed, some cash advance apps partner with third party financial services, including payment processors, credit score services and budgeting applications to add value for users.

Introduction

In recent years, fintech apps have completely changed how we perfectly deal with personal finance\ by offering simple, free access and helping us take control of our money. Popular cash advance apps such as MoneyLion have become wildly popular because users can quickly and easily obtain emergency funds without the messiness of traditional loans or credit checks. They’re apps that offer immediate financial relief — with no interest nor hidden fees — which makes them game-changing for people facing unexpected expenses.

As such apps are on the rise, users can cross that gap between paychecks or deal with an emergency without going for payday loans with prohibitive interest rates. As these apps evolve, they’re getting more user-friendly and feature-rich, with budgeting tools, credit score monitoring, and more.

To find the best 15 cash advance apps like MoneyLion, this blog will teach you what to look for when looking for a financial tool. Whether you want some extra cash or a full financial platform, this list can serve as viable alternatives for what you’re looking for.

What is an Instant Cash Advance App?

Instant cash advance app is an app type that enables users to get small loans or cash advances instantaneously before the next paycheck. The apps are meant to give quick financial relief from things like medical bills, car repair, or shopping at the grocery store.

Cash advance apps are also unlike traditional loans, which do not require a credit check or extensive approval process. They also make them a good option, especially for people with poor or no credit history.

However, cash advance apps tend to provide a small amount of money that has to be paid back as they get the next paycheck; some apps charge a small fee or ask for voluntary tips, while others give you interest-free advances.

The user-friendly and fast approval processes these apps offer have earned them popularity as a convenient way to get fast cash without any long-term commitment to the finances.

What is MoneyLion?

A popular financial wellness platform, MoneyLion provides services to help users effectively manage their financial lives. The app is powerful and sophisticated and encompasses many features such as account monitoring, account budgeting tools, financial planning resources, personal loans, and many more in one neat and convenient app. First, its claim to fame is that it offers the ability to get funds when needed—filling the gap between paychecks or unexpected expenses.

MoneyLion offers a standout cash advance service. It offers users access to small loans or cash advances against their upcoming paychecks without the high interest and hidden fee baggage often associated with payday loans. Users of MoneyLion can borrow up to $250 in cash advances, and that doesn’t involve carrying out a credit check, which makes it an option for those with dodgy or poor credit histories.

The app's simplicity and transparency around its terms make it a surprisingly popular choice among those needing immediate, fast relief. In addition, MoneyLion provides tools to build credit and financial education to help users achieve financial health overall.

Requirements and Costs Associated with MoneyLion

Users of MoneyLion must sign up for an account, which is free, although there may be a monthly cost for the features. Premium subscription cost range, but they have a few tiers with added perks like increased cash advance limit, free credit monitoring and investment tools.

The free plan provides access to the platform's tools, including the small cash advance and small budgeting features. However, users might be subject to fees for certain transactions, including expedited transfers.

Best 15 Cash Advance Apps Like MoneyLion in 2025

The Top 15 Cash Advance Apps Like MoneyLion in 2025 With All The Features of Quick Hairy-Free Immediate Available Cash To Use For Meeting Short-Term Financial Requirements.

Brigit

Brigit is an app that provides fast access to emergency funds with a cash advance. This one actually supplies instant cash advances of up to $250 with zero credit checks, making it perfect for folks who require money they don’t have until payday.

It also monitors potential overdraft fees to track users' bank accounts and when they might need to top up their accounts. Brigit offers a subscription-based service that helps people be financially stable.

Chime

One of those services is SpotMe, which is Chime's cash advance feature that functions like a line of credit: a revolving credit limit that you can borrow from at any time, so long as it's less than your maximum available limit. Users can borrow up to $200 in overdraft protection with fees or interest charges without fee.

Chime has no monthly fees and is available to use two days early on direct paychecks. The app also offers automatic savings tools and credit-building resources for financial health.

Dave

Dave is a mobile app that offers small cash advances of up to $200 without credit checks or interest fees. It also allows users to avoid overdraft fees by offering early payday advances.

In addition, Dave provides budgeting tips and financial insights, tracking spending and steering clear of the many pitfalls that create financial strain. There is also a cash-back reward available to app users who make purchases.

Affirm

Buy now, pay later (BNPL) platform Affirm is known for providing flexible finances for consumers. Through Affirm, you can break a purchase up into instalments, making more expensive purchases less overwhelming.

The app charges transparent terms and no hidden fees and offers financing options from 3 to 12 months. Affirm lets you instantly know whether you’re eligible, and thousands of online retailers accept it, so it’s a popular alternative to traditional credit cards.

AfterPay

The buy now, pay later app AfterPay splits purchases into four instalments, which are paid every two weeks without interest. Online shoppers can appreciate that it is popular for accepting payments with flexible payment terms and no fees, provided payments are made on time—easy access to procure and pay for the products later.

AfterPay provides users with ease in managing their spending. A lot of retailers accept and have a mobile app to manage purchases, and a lot of retailers accept it.

Klover

Klover is a cash advance financial app powered by paycheck history. This allows you to get up to $200 in instant cash, no credit checks, no fees, and no interest. Klover gets data from users' bank accounts to guess future income and which cash advances are approved.

The app also offers budgeting tools and financial insights for easier management of the user's finances. Klover is a free, transparent, low-cost way to get money in your pocket quickly and inadvertently.

Rufilo

Rufilo is a personal finance app that provides cash advances and instant loan facilities up to $250. With no credit checks, the app makes it easy to use for those with a poor or limited credit history.

Rufilo also provides users with budgeting and money management tools to keep them out of future financial troubles. Its basic services come with no interest or fees, so it is a convenient way to get access to money fast, which can be helpful when you need money fast and need it cheap.

Pocketly

Pocketly is a user-friendly mobile app that manages short-term financial emergencies by offering cash advances of up to $250. It has no credit check requirements and is suitable for anyone with different credit histories.

The app also offers automatic saving tools and financial management features to help users track spending and avoid getting trapped in future financial pitfalls. Pocketly intends to make transactions fast and reliable for its users by using a user-friendly interface.

CASHe

CASHe is a cash advance app that advances cash to users as per their financial needs without the hassle. With flexibility on repayment and minimal interest rates, CASHe offers cash advances upto ₹5,000 to ₹1,00,000.

The app uses social scoring to assess eligibility, so it doesn’t depend on traditional credit checks. Furthermore, it gives users customized loan offers and financial education tools to assist users in making knowledgeable decisions about their money.

FlexWage

FlexWage is an EWA service that lets employees access their earned wages before paydays. The FlexWage app allows users to access up to 50% of their earned wages, giving them a financial cushion between paychecks.

Its service helps employees avoid payday loans and overdraft fees. FlexWage integrates well with employers' payroll systems, ensuring a seamless experience for its users looking to access their wages early.

Empower

Empower is a mobile app designed to enable its users to maintain proper finance management using an automated savings and budgeting tool. Users are offered the facility to receive cash advances up to $250 without credit checks and no interest fees.

Artificial intelligence is used in this application, which analyses users' expenditure habits and guides them toward saving money automatically. It also gives customised financial recommendations for bettering the financial health of its users and decreasing avoidable expenditures.

Earnin

Earnin is an application that gives users access to earned wages before payday. Withdrawals are allowed for up to $100 per day without interest or credit checks. It allows the users to pay only what they consider fair for the service.

It has a pay-what-you-can model. The app also provides balance alerts, timecard tracking, and a wellness program made to help the user keep their financial health in place by managing cash flow appropriately.

Cleo

Cleo is a budgeting and cash advance app that gives users easy financial tools to manage their spending and save. It provides cash advances up to $100 with no interest or hidden fees.

Furthermore, Cleo offers budgeting tools, personalised spending insights, and financial advice to improve user financial decisions. Cleo engages users in a conversational format and uses artificial intelligence to promote a fun, interactive manner in improving their financial health.

PayActiv

PayActiv is an app for earned wage access that lets users access their hard-earned wages before payday comes in. It offers them an advance of up to 50% of a user's earned wages free from interest or credit check implications.

PayActiv features some financial wellness tools that help users manage how to spend their money appropriately, including bill payments, transferring money, and directing savings from their earned wages. This works in harmony with employers' payroll systems and is a fantastic tool for employees looking to avoid payday loans.

Avant Credit

Avant Credit provides loans from $2,000 to $35,000. Although it does not qualify as a more conventional cash advance app, it still allows consumers to receive money through unsecured personal loans.

It offers reasonable interest rates and flexible repayment options, which is highly suited for larger, longer-term financial needs. Avant Credit offers a relatively straightforward platform to manage your loan and thus remains the most trusted for customers irrespective of credit scores.

Here's a table for the top 15 applications like MoneyLion that similarly provide services such as cash advances and financial health monitoring and the rest:

How Do Cash Apps Work?

Cash advance apps get a hold of your bank account and let you take small amounts of money whenever your next paycheck comes and repay it. These are such a quick solution because these apps usually don’t require credit checks.

The apps calculate your borrowing limit based on your income and repayment history. Almost all of the apps on this list have a subscription or fee-based model, or they are free unless you tip the app developer.

5 Key Features to Look for in a Cash Advance App Like MoneyLion

When selecting a cash advance app, consider these five key features:

Instant Money Access: The main reason why cash advance apps are popular is that it’s so easy to get your hands on cash right away. Apps that allow you to instantly transfer cash into your account, such as a linked debit card, are what you should look for.

No Credit Check: Many cash advance apps do not require a credit check, making them available for people with poor credit. Those in need of immediate relief but facing traditional credit approval processes will discover this feature particularly useful.

Low Fees or No Fees: Although some are fee-free or run based on tips, these apps are actually cheaper than payday loans. Choose apps with transparent costs.

Flexible Repayment Terms: The best cash advance app will allow you to make repayments in terms that match your paydays. This enables users to break down the cycle of debt.

Additional Financial Tools: Apps like MoneyLion come with budgeting, savings, and even credit-building tools that can increase the app's overall value. Check out apps that offer more than just the cash advance feature and supply resources to help you manage your finances if any issues arise.

Conclusion

Fintech businesses are currently able to tap into this growing market as the demand for instant cash advance apps has soared. The recent obsession with mobile-based financial solutions makes developing an app similar to MoneyLion extremely profitable. Long-term engagement will offer users quick access to funds and allow businesses to offer budgeting tools, credit score tracking, and financial management features.

As a business, potential cash advance app companies can monetise by means of subscription models, transaction fees and partnerships with credit providers. These apps can quickly attract a large user base by offering a seamless and easy-to-use experience. Businesses can also utilize data insight to come up with the type of financial products and services customers need.

Moreover, as mobile app development in the fintech sector evolves, incorporating AI, machine learning, and rich analytics will enable businesses to create more personal financial solutions. This helps make cash advance apps relevant, reliable, and profitable in a changing financial landscape.

FAQs

Q: How much does it cost to develop a similar app?

A: Depends on the features and complexity, but developing money lion app like Cash Advance app might cost you $50,000 to $200,000.

Q: What technologies are used to build apps like MoneyLion?

A: Popular technologies include mobile app frameworks such as React Native or Flutter, backend technologies such as Node.js or Ruby on Rails, and cloud services like AWS or Google Cloud.

Q: How long does it take to develop a fintech app?

A: This process takes roughly 4 to 6 months to develop, depending on the complexity of the features, testing, and regulatory compliance.

Q: How do you ensure data security in financial apps?

A: Encryption, two-factor authentication, security audits, and our 100% compliance with financial regulations such as GDPR and PCI DSS are ways we prove data security.

Q: Can these apps integrate with third-party financial services?

A: Indeed, some cash advance apps partner with third party financial services, including payment processors, credit score services and budgeting applications to add value for users.

Introduction

In recent years, fintech apps have completely changed how we perfectly deal with personal finance\ by offering simple, free access and helping us take control of our money. Popular cash advance apps such as MoneyLion have become wildly popular because users can quickly and easily obtain emergency funds without the messiness of traditional loans or credit checks. They’re apps that offer immediate financial relief — with no interest nor hidden fees — which makes them game-changing for people facing unexpected expenses.

As such apps are on the rise, users can cross that gap between paychecks or deal with an emergency without going for payday loans with prohibitive interest rates. As these apps evolve, they’re getting more user-friendly and feature-rich, with budgeting tools, credit score monitoring, and more.

To find the best 15 cash advance apps like MoneyLion, this blog will teach you what to look for when looking for a financial tool. Whether you want some extra cash or a full financial platform, this list can serve as viable alternatives for what you’re looking for.

What is an Instant Cash Advance App?

Instant cash advance app is an app type that enables users to get small loans or cash advances instantaneously before the next paycheck. The apps are meant to give quick financial relief from things like medical bills, car repair, or shopping at the grocery store.

Cash advance apps are also unlike traditional loans, which do not require a credit check or extensive approval process. They also make them a good option, especially for people with poor or no credit history.

However, cash advance apps tend to provide a small amount of money that has to be paid back as they get the next paycheck; some apps charge a small fee or ask for voluntary tips, while others give you interest-free advances.

The user-friendly and fast approval processes these apps offer have earned them popularity as a convenient way to get fast cash without any long-term commitment to the finances.

What is MoneyLion?

A popular financial wellness platform, MoneyLion provides services to help users effectively manage their financial lives. The app is powerful and sophisticated and encompasses many features such as account monitoring, account budgeting tools, financial planning resources, personal loans, and many more in one neat and convenient app. First, its claim to fame is that it offers the ability to get funds when needed—filling the gap between paychecks or unexpected expenses.

MoneyLion offers a standout cash advance service. It offers users access to small loans or cash advances against their upcoming paychecks without the high interest and hidden fee baggage often associated with payday loans. Users of MoneyLion can borrow up to $250 in cash advances, and that doesn’t involve carrying out a credit check, which makes it an option for those with dodgy or poor credit histories.

The app's simplicity and transparency around its terms make it a surprisingly popular choice among those needing immediate, fast relief. In addition, MoneyLion provides tools to build credit and financial education to help users achieve financial health overall.

Requirements and Costs Associated with MoneyLion

Users of MoneyLion must sign up for an account, which is free, although there may be a monthly cost for the features. Premium subscription cost range, but they have a few tiers with added perks like increased cash advance limit, free credit monitoring and investment tools.

The free plan provides access to the platform's tools, including the small cash advance and small budgeting features. However, users might be subject to fees for certain transactions, including expedited transfers.

Best 15 Cash Advance Apps Like MoneyLion in 2025

The Top 15 Cash Advance Apps Like MoneyLion in 2025 With All The Features of Quick Hairy-Free Immediate Available Cash To Use For Meeting Short-Term Financial Requirements.

Brigit

Brigit is an app that provides fast access to emergency funds with a cash advance. This one actually supplies instant cash advances of up to $250 with zero credit checks, making it perfect for folks who require money they don’t have until payday.

It also monitors potential overdraft fees to track users' bank accounts and when they might need to top up their accounts. Brigit offers a subscription-based service that helps people be financially stable.

Chime

One of those services is SpotMe, which is Chime's cash advance feature that functions like a line of credit: a revolving credit limit that you can borrow from at any time, so long as it's less than your maximum available limit. Users can borrow up to $200 in overdraft protection with fees or interest charges without fee.

Chime has no monthly fees and is available to use two days early on direct paychecks. The app also offers automatic savings tools and credit-building resources for financial health.

Dave

Dave is a mobile app that offers small cash advances of up to $200 without credit checks or interest fees. It also allows users to avoid overdraft fees by offering early payday advances.

In addition, Dave provides budgeting tips and financial insights, tracking spending and steering clear of the many pitfalls that create financial strain. There is also a cash-back reward available to app users who make purchases.

Affirm

Buy now, pay later (BNPL) platform Affirm is known for providing flexible finances for consumers. Through Affirm, you can break a purchase up into instalments, making more expensive purchases less overwhelming.

The app charges transparent terms and no hidden fees and offers financing options from 3 to 12 months. Affirm lets you instantly know whether you’re eligible, and thousands of online retailers accept it, so it’s a popular alternative to traditional credit cards.

AfterPay

The buy now, pay later app AfterPay splits purchases into four instalments, which are paid every two weeks without interest. Online shoppers can appreciate that it is popular for accepting payments with flexible payment terms and no fees, provided payments are made on time—easy access to procure and pay for the products later.

AfterPay provides users with ease in managing their spending. A lot of retailers accept and have a mobile app to manage purchases, and a lot of retailers accept it.

Klover

Klover is a cash advance financial app powered by paycheck history. This allows you to get up to $200 in instant cash, no credit checks, no fees, and no interest. Klover gets data from users' bank accounts to guess future income and which cash advances are approved.

The app also offers budgeting tools and financial insights for easier management of the user's finances. Klover is a free, transparent, low-cost way to get money in your pocket quickly and inadvertently.

Rufilo

Rufilo is a personal finance app that provides cash advances and instant loan facilities up to $250. With no credit checks, the app makes it easy to use for those with a poor or limited credit history.

Rufilo also provides users with budgeting and money management tools to keep them out of future financial troubles. Its basic services come with no interest or fees, so it is a convenient way to get access to money fast, which can be helpful when you need money fast and need it cheap.

Pocketly

Pocketly is a user-friendly mobile app that manages short-term financial emergencies by offering cash advances of up to $250. It has no credit check requirements and is suitable for anyone with different credit histories.

The app also offers automatic saving tools and financial management features to help users track spending and avoid getting trapped in future financial pitfalls. Pocketly intends to make transactions fast and reliable for its users by using a user-friendly interface.

CASHe

CASHe is a cash advance app that advances cash to users as per their financial needs without the hassle. With flexibility on repayment and minimal interest rates, CASHe offers cash advances upto ₹5,000 to ₹1,00,000.

The app uses social scoring to assess eligibility, so it doesn’t depend on traditional credit checks. Furthermore, it gives users customized loan offers and financial education tools to assist users in making knowledgeable decisions about their money.

FlexWage

FlexWage is an EWA service that lets employees access their earned wages before paydays. The FlexWage app allows users to access up to 50% of their earned wages, giving them a financial cushion between paychecks.

Its service helps employees avoid payday loans and overdraft fees. FlexWage integrates well with employers' payroll systems, ensuring a seamless experience for its users looking to access their wages early.

Empower

Empower is a mobile app designed to enable its users to maintain proper finance management using an automated savings and budgeting tool. Users are offered the facility to receive cash advances up to $250 without credit checks and no interest fees.

Artificial intelligence is used in this application, which analyses users' expenditure habits and guides them toward saving money automatically. It also gives customised financial recommendations for bettering the financial health of its users and decreasing avoidable expenditures.

Earnin

Earnin is an application that gives users access to earned wages before payday. Withdrawals are allowed for up to $100 per day without interest or credit checks. It allows the users to pay only what they consider fair for the service.

It has a pay-what-you-can model. The app also provides balance alerts, timecard tracking, and a wellness program made to help the user keep their financial health in place by managing cash flow appropriately.

Cleo

Cleo is a budgeting and cash advance app that gives users easy financial tools to manage their spending and save. It provides cash advances up to $100 with no interest or hidden fees.

Furthermore, Cleo offers budgeting tools, personalised spending insights, and financial advice to improve user financial decisions. Cleo engages users in a conversational format and uses artificial intelligence to promote a fun, interactive manner in improving their financial health.

PayActiv

PayActiv is an app for earned wage access that lets users access their hard-earned wages before payday comes in. It offers them an advance of up to 50% of a user's earned wages free from interest or credit check implications.

PayActiv features some financial wellness tools that help users manage how to spend their money appropriately, including bill payments, transferring money, and directing savings from their earned wages. This works in harmony with employers' payroll systems and is a fantastic tool for employees looking to avoid payday loans.

Avant Credit

Avant Credit provides loans from $2,000 to $35,000. Although it does not qualify as a more conventional cash advance app, it still allows consumers to receive money through unsecured personal loans.

It offers reasonable interest rates and flexible repayment options, which is highly suited for larger, longer-term financial needs. Avant Credit offers a relatively straightforward platform to manage your loan and thus remains the most trusted for customers irrespective of credit scores.

Here's a table for the top 15 applications like MoneyLion that similarly provide services such as cash advances and financial health monitoring and the rest:

How Do Cash Apps Work?

Cash advance apps get a hold of your bank account and let you take small amounts of money whenever your next paycheck comes and repay it. These are such a quick solution because these apps usually don’t require credit checks.

The apps calculate your borrowing limit based on your income and repayment history. Almost all of the apps on this list have a subscription or fee-based model, or they are free unless you tip the app developer.

5 Key Features to Look for in a Cash Advance App Like MoneyLion

When selecting a cash advance app, consider these five key features:

Instant Money Access: The main reason why cash advance apps are popular is that it’s so easy to get your hands on cash right away. Apps that allow you to instantly transfer cash into your account, such as a linked debit card, are what you should look for.

No Credit Check: Many cash advance apps do not require a credit check, making them available for people with poor credit. Those in need of immediate relief but facing traditional credit approval processes will discover this feature particularly useful.

Low Fees or No Fees: Although some are fee-free or run based on tips, these apps are actually cheaper than payday loans. Choose apps with transparent costs.

Flexible Repayment Terms: The best cash advance app will allow you to make repayments in terms that match your paydays. This enables users to break down the cycle of debt.

Additional Financial Tools: Apps like MoneyLion come with budgeting, savings, and even credit-building tools that can increase the app's overall value. Check out apps that offer more than just the cash advance feature and supply resources to help you manage your finances if any issues arise.

Conclusion

Fintech businesses are currently able to tap into this growing market as the demand for instant cash advance apps has soared. The recent obsession with mobile-based financial solutions makes developing an app similar to MoneyLion extremely profitable. Long-term engagement will offer users quick access to funds and allow businesses to offer budgeting tools, credit score tracking, and financial management features.

As a business, potential cash advance app companies can monetise by means of subscription models, transaction fees and partnerships with credit providers. These apps can quickly attract a large user base by offering a seamless and easy-to-use experience. Businesses can also utilize data insight to come up with the type of financial products and services customers need.

Moreover, as mobile app development in the fintech sector evolves, incorporating AI, machine learning, and rich analytics will enable businesses to create more personal financial solutions. This helps make cash advance apps relevant, reliable, and profitable in a changing financial landscape.

FAQs

Q: How much does it cost to develop a similar app?

A: Depends on the features and complexity, but developing money lion app like Cash Advance app might cost you $50,000 to $200,000.

Q: What technologies are used to build apps like MoneyLion?

A: Popular technologies include mobile app frameworks such as React Native or Flutter, backend technologies such as Node.js or Ruby on Rails, and cloud services like AWS or Google Cloud.

Q: How long does it take to develop a fintech app?

A: This process takes roughly 4 to 6 months to develop, depending on the complexity of the features, testing, and regulatory compliance.

Q: How do you ensure data security in financial apps?

A: Encryption, two-factor authentication, security audits, and our 100% compliance with financial regulations such as GDPR and PCI DSS are ways we prove data security.

Q: Can these apps integrate with third-party financial services?

A: Indeed, some cash advance apps partner with third party financial services, including payment processors, credit score services and budgeting applications to add value for users.

Introduction

In recent years, fintech apps have completely changed how we perfectly deal with personal finance\ by offering simple, free access and helping us take control of our money. Popular cash advance apps such as MoneyLion have become wildly popular because users can quickly and easily obtain emergency funds without the messiness of traditional loans or credit checks. They’re apps that offer immediate financial relief — with no interest nor hidden fees — which makes them game-changing for people facing unexpected expenses.

As such apps are on the rise, users can cross that gap between paychecks or deal with an emergency without going for payday loans with prohibitive interest rates. As these apps evolve, they’re getting more user-friendly and feature-rich, with budgeting tools, credit score monitoring, and more.